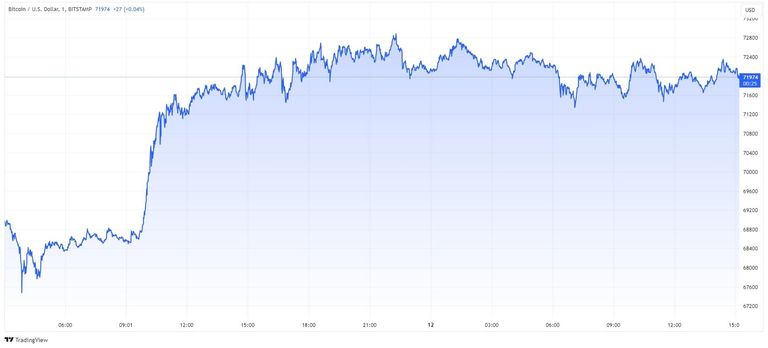

BTCUSD continues its surge, breaking new all-time highs and nearing a valuation of $1.5 trillion, which is nearly three times the market cap of struggling electric vehicle maker Tesla, currently valued at $550 billion.

The crypto community worldwide is on edge as the original cryptocurrency shatters its previous record of $69,000, reaching a new peak of $72,800 early on Tuesday before settling around $72,000 later.

But the wave of positivity doesn’t end there. The newly-launched spot Bitcoin ETFs have amassed a staggering $50 billion in assets. The largest among them, the iShares Bitcoin Trust managed by BlackRock, has attracted around 20% of these funds.

Companies involved in the crypto space are also reaping the rewards as Bitcoin’s rally continues, driven by factors such as the halving event, the introduction of BTC ETFs, and heightened geopolitical uncertainties.

Coinbase, for instance, has seen its shares skyrocket by over 700% since the beginning of last year, bouncing back from a 90% decline. Notably, Goldman Sachs and the KBW team have recently upgraded their ratings on the stock in acknowledgment of this growth.

Similarly, MicroStrategy Incorporated has witnessed a substantial surge in its shares, nearly doubling over the past month. This increase aligns with the rising value of Bitcoin, in which the company has made significant investments.MicroStrategy has utilized funds from its private offerings of convertible senior notes to invest in Bitcoin.

These investments have significantly boosted MicroStrategy’s Bitcoin holdings. Following the recent purchase of an additional 12,000 Bitcoin, the company now holds approximately 205,000 Bitcoin.

As Bitcoin continues to break records and attract substantial investment, the future remains uncertain yet promising. Whether this rally will sustain its momentum or encounter obstacles along the way is yet to be determined. However, one thing is clear: the impact of Bitcoin’s rally extends far beyond its own market.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

This article was originally published by a www.kitco.com . Read the Original article here. .