After hitting a low at $3,050, Ethereum has recorded a 20% rise. Let’s examine the future outlook for ETH together.

Ethereum Situation (ETH)

After reaching $3,050, the price of Ethereum has sparked buying interest, propelling it to $3,600. This interest was supported a second time, with $3,300 acting as support, allowing it to subsequently join the resistance at $3,680. At the time of writing, one ether is equivalent to $3,545. Thus, it seems that Ethereum is struggling to cross this last resistance. Naturally, this could strengthen the selling conviction. However, the short-term structure of Ethereum still suggests an upcoming uptrend.

Ethereum has thus rebounded from its 50-day moving average and is beginning to move away from it. This theoretically suggests a continuation of the current trend. As for the cryptocurrency’s momentum, it has slightly rebounded as illustrated by oscillators and the price of Ethereum itself.

The current technical analysis was conducted in collaboration with Elie FT, an investor and trader passionate about the cryptocurrency market. He is now a trainer at Family Trading, a community of thousands of self-account traders active since 2017. There you will find Live sessions, educational content, and mutual support around financial markets in a professional and warm atmosphere.

Focus on Derivatives (ETHUSDT)

The open interest on ETH/USDT contracts followed the direction of its price, which is rising. It has increased by 16% since Ethereum rebound from $3,300. This increase has been accompanied by very slight liquidations, mostly on the selling side, as well as a subtle rise in the funding rate. This indicates that the investor interest in ETH/USDT perpetual contracts is primarily oriented towards buying.

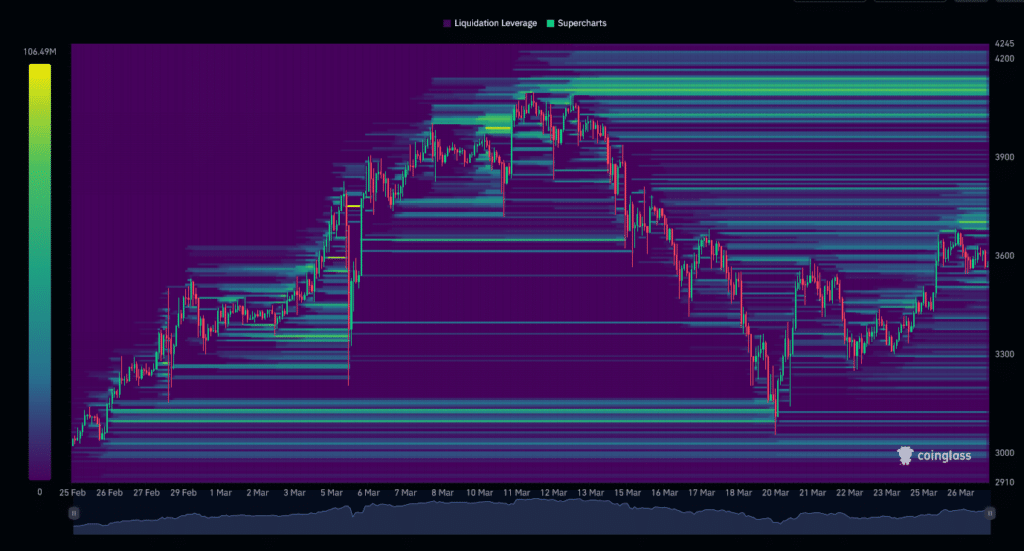

The one-month liquidation heat map for ETH/USDT reveals that the liquidation zone around $3,100 has garnered buying interest in the cryptocurrency. However, the fresh liquidation zone just below $3,700 has clearly triggered some selling interest. Today, the most significant liquidation zones are above $3,700, and higher up, around $4,100. Below the current price, the $3,000 zone is still noteworthy. The price’s approach to these levels could trigger a massive order unleashing, thereby increasing the risk of a period of increased volatility for Ethereum. These zones thus represent a crucial point of interest for investors.

Potential Scenarios for Ethereum Price (ETH)

- If Ethereum’s price holds above $3,300, we could anticipate a bullish continuation up to the $3,900 level. The next resistance to consider, if the bullish movement continues, would be at $4,100. At this stage, this would represent an increase of more than +15%.

- If Ethereum’s price fails to hold above $3,300, we could envisage a retreat to $3,000. The next support to consider, if the bearish movement continues, would be around $2,900. At this stage, this would represent a decline close to -18%.

Conclusion

Despite initial selling pressure, Ethereum shows signs of a bullish recovery. As positive as this may appear, it is important to note that the market’s direction still struggles to define itself. Thus, it will be crucial to closely observe the price reaction at the various key levels to confirm or invalidate the current assumptions. It is also important to remain vigilant regarding potential market “fake outs” and “squeezes” in each scenario. Finally, remember that these analyses are based solely on technical criteria and that cryptocurrency prices can also move quickly based on other more fundamental factors.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Family Trading

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

Disclaimer:

The contents and products mentioned on this page are in no way endorsed by Cointribune and should not be construed as its responsibility.

Cointribune strives to provide readers with all relevant information available, but cannot guarantee its accuracy or completeness. Readers are urged to make their own inquiries before taking any action with respect to the company, and to assume full responsibility for their decisions. This article does not constitute investment advice or an offer or invitation to purchase any products or services.

Investing in digital financial assets involves risks.

This article was originally published by a www.cointribune.com . Read the Original article here. .