(Kitco News) – The cryptocurrency market ended the week on a negative note as Bitcoin (BTC) slid back below $64,000 while the broader altcoin market recorded losses amid continued profit-taking by traders looking to reposition themselves ahead of the next major uptrend.

Stocks also fell under pressure after Thursday’s rally saw all three major indexes hit new record highs at the prospect of lower interest rates. At the market close, the S&P, and Dow finished in the red, down 0.14% and 0.77%, while the Nasdaq managed to battle back from negative territory to finish the day up 0.16%.

While stock investors are cheering the new record highs, crypto investors used the opportunity to take a subtle dig at the accomplishment.

Imagine two people.

Person A put all of their money in the S&P 500 10 years ago.

Person B put all of their money in Bitcoin 10 years ago.

Person A’s portfolio is at an all-time high today. Person B’s portfolio is 13% off its high.

— Joe Weisenthal (@TheStalwart) March 22, 2024

Although it’s true Bitcoin has fallen more than 13% from its recent high while the S&P is only down roughly 0.5%, it’s important to note that since 2014, Bitcoin’s price has increased by more than 29,000%, while the S&P is up 195%. Gold’s price increased 91.5% during that period.

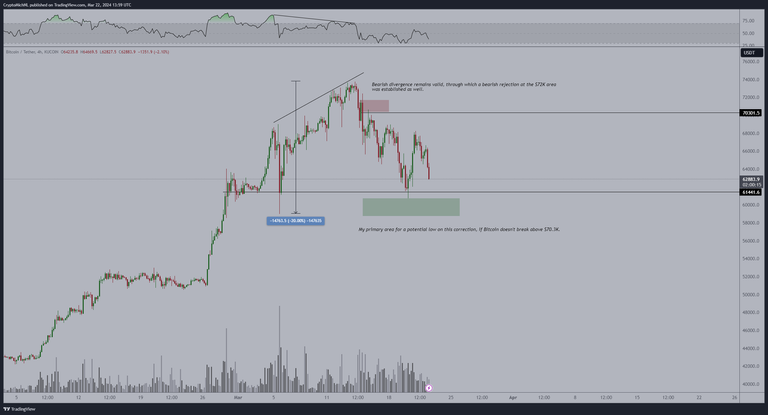

BTC/USD Chart by TradingView

At the time of writing, BTC trades at $63,570, a decline of 2.3% on the 24-hour chart.

“After Bitcoin continued to bleed throughout yesterday, we saw a nice reaction from the previous week’s Low at $64.6k,” said market analyst CryptoChiefs.

“This could be setting up for a nice inverse head and shoulders pattern, however, there is clearly resistance trying to reclaim the Monday low at $65.6k,” they said. “If we see acceptance above this then we can look for a move towards the Weekly Open area ($68.4k) but if we keep rejecting, then I’ll be looking for a move lower.”

“Bitcoin’s price might be dropping, but BlackRock’s inflow in the Spot Bitcoin ETF is constantly positive,” Poppe added. “This means the institutions keep on buying. Big sign in there, [suggesting] that we’re far from done with this cycle.”

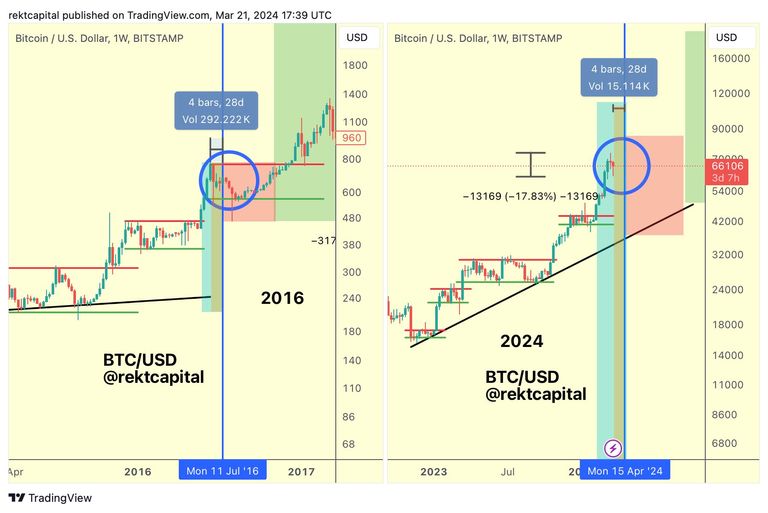

First, there is a “Breakout from the Pre-Halving Re-Accumulation Range (green-red range),” he said. Second, comes the pre-halving rally (light blue), followed by a pre-halving retrace (dark blue circle), the post-halving re-accumulation range (red box), and then “parabolic upside.”

“This current Pre-Halving Retrace is setting up a future Post-Halving Re-Accumulation Range so as to set up the future Parabolic Upside phase of the cycle,” Rekt Capital said.

Altcoin correct amid pre-halving lull

Daily cryptocurrency market performance. Source: Coin360

A 21.9% gain from DeXe (DEXE) led the field, followed by a 16.2% increase for DAO Maker (DAO), and a gain of 11.5% for Aptos (APT). Echelon Prime (PRIME) dropped 9.3% to lead the losers, while Raydium (RAY) lost 8%, and Flux (FLUX) declined by 7.7%.

The overall cryptocurrency market cap now stands at $2.43 trillion, and Bitcoin’s dominance rate is 51.7%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

This article was originally published by a www.kitco.com . Read the Original article here. .