Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

In a much-anticipated move, the Federal Reserve’s policy committee, known as the Federal Open Market Committee (FOMC), decided to keep interest rates steady at their recent meeting. This decision comes amid ongoing concerns about inflation, but the latest figures show signs of easing. As a result, markets, including cryptocurrencies, are bracing for changes.

The FOMC is a key player in setting US monetary policy. It meets regularly to decide on interest rates, aiming to balance job growth with stable prices. In their latest meeting held on June 12th 2024, the committee kept the target interest rate unchanged at 5.25% to 5.50%. This decision, while expected, was made with an eye on inflation trends. Recent data showed inflation rising 3.3% over the past year, with a small 0.2% increase in May. This was enough to calm markets and raise hopes for possible rate cuts that are anticipated for later in the year.

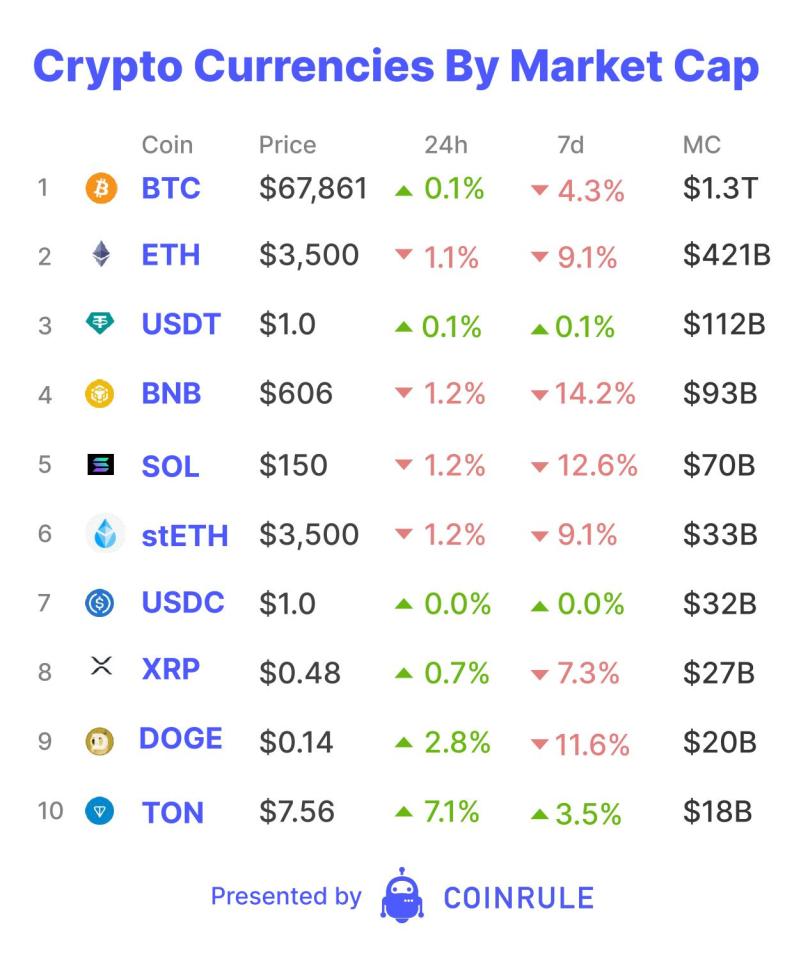

Cryptocurrencies have had a rocky relationship with the Fed’s policies. When the Fed started raising interest rates aggressively in 2022 to control inflation, the crypto market witnessed a severe downturn. Higher interest rates make borrowing more expensive, leading investors to pull back from risky assets like Bitcoin and Ethereum. However, the recent pause in rate hikes brought a breath of fresh air. After the latest CPI report, which hinted at cooling inflation, Bitcoin and Ethereum both surged by about 4%, with Bitcoin briefly touching the $70,000 mark before settling slightly lower. Traditional markets also reacted to this event with the the S&P 500 and Nasdaq Composite indexes rallying around 1% and 2% respectively, following the announcement.

Looking ahead, the crypto market is at a critical point. The Fed’s steady hand on interest rates suggests a period of potential volatility. With the CPI figures hinting at easing inflation, there’s speculation about a rate cut in the near future. This could introduce swings in crypto prices. Interestingly, most of the recent price drops in crypto have already taken out downside liquidity, meaning there’s less pressure on prices to fall. This shifts the focus to the upside, suggesting that the market could see more upward movement if volatility kicks in.

But despite these short-term possibilities, the mid-term outlook for cryptocurrencies remains uncertain. The market may continue to trade sideways, waiting for a new trigger to set the direction. The Ethereum ETF is one candidate to keep in mind as a catalyst for a significant move upward. The approval of this asset could potentially channel billion dollars into the Ethereum blockchain.This wouldn’t be a game changer for ETH only, as it can also represent an opportunity for a significant altcoin rally.

Ultimately, the Fed’s current stance offers a moment of calm but leaves the door open for wilder fluctuations to come. As the Fed balances inflation control with economic growth, crypto investors should stay alert, ready for a market that could swing either way, influenced by traditional financial policies and the unique dynamics of digital assets.

This article was originally published by a www.cityam.com . Read the Original article here. .