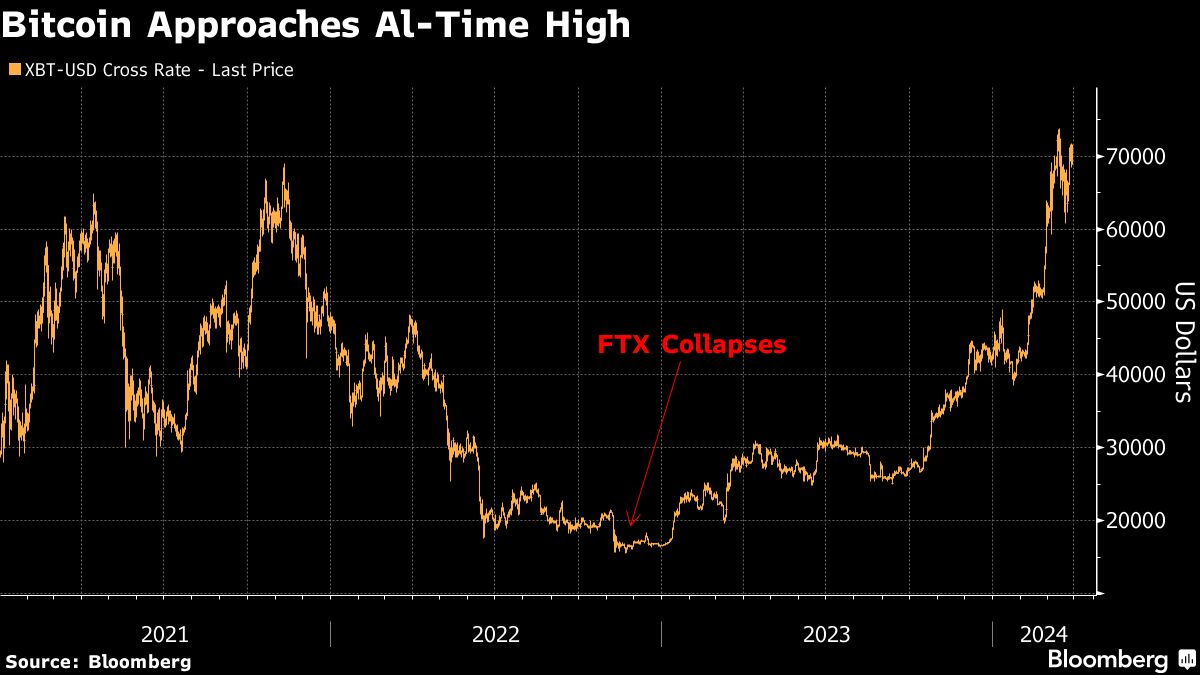

(Bloomberg) — Sam Bankman-Fried was sentenced to prison for 25 years. More than $20 billion in Tether transactions are being reviewed for possible sanctions violations. The surviving co-founder of Quadriga is being asked where he got a hoard of gold and cash. And Bitcoin is approaching record highs.

Most Read from Bloomberg

Prices of most digital assets were higher on Thursday while FTX co-founder Bankman-Fried was sentenced for stealing billions of dollars from customers, marking the final chapter in a case that has both captivated and overshadowed the crypto industry.

“We are focused on the crypto market, and this trial is the conclusion of a sorry episode that the market has moved on from,” said Michael Silberberg, head of investor relations at the crypto hedge fund Alt Tab Capital.

Bitcoin rose as much as 3.9% to $71,555, advancing toward an all-time high of $73,797 set two weeks ago. The largest digital currency has jumped almost 70% this year amid persistent demand for US exchange-traded funds holding the token. It had sunk to about $15,000 when FTX collapsed in late 2022.

“It’s astounding what kind of turn-around the crypto industry has seen since the downfall of FTX,” said Strahinja Savic, head of data and analytics at FRNT Financial. “Despite some of the nastiest headlines imaginable, the SBF saga did not dissuade institutions from embracing crypto.”

Meanwhile, other long-time industry concerns and problems that resurfaced Thursday have drawn little heed from traders.

Canadian officials are seeking to force Michael Patryn, the surviving co-founder of the collapsed exchange QuadrigaCX, to explain how he came by a cash hoard, 45 gold bars and jewelry including a diamond-studded Rolex. An official probe in 2020 concluded that the exchange’s failure was the result of fraud by its other founder Gerry Cotten, who died unexpectedly in 2018, an incident that captivated the industry at the time.

And the US and UK are reviewing more than $20 billion of cryptocurrency transactions using Tether that passed through a Russia-based virtual exchange, according to people familiar with the matter, as part of allied efforts to crack down on the sanctions evasion that’s supporting Vladimir Putin’s war in Ukraine. Tether, the world’s most traded cryptocurrency, has long been dogged by concerns about questionable use of the largest stablecoin. The token retained its one-to-one peg to the dollar.

Still, long-time skeptics remain unconvinced of the merits of digital assets.

“Yes, Bitcoin is up to a new high, but that proves little, given its chronic volatility,” said John Coffee, a professor at Columbia Law School. “SBF showed just how risky trading in cryptocurrencies is and how minimal the internal controls were. The governance of FTX was less rigorous than that at Animal House. Moreover, it remains the case that the chief utility of these currencies is to facilitate money laundering and the leading beneficiary of these currencies is drug cartels. The SEC remains properly skeptical of them.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

This article was originally published by a finance.yahoo.com . Read the Original article here. .