In a bold appeal to the European Union, Sarah Knafo, a French Member of the European Parliament, has made waves in the cryptocurrency community by urging European nations to adopt Bitcoin as a strategic reserve. Rejecting the central bank digital currency (CBDC) model, Knafo advocates for decentralization as a safeguard against inflation and centralized economic control. Her position has garnered attention, even from El Salvador’s pro-Bitcoin president, Nayib Bukele, who extended his support across the Atlantic.

During a parliamentary speech delivered on Tuesday, Knafo called on the European Union to reject the path of centralized digital currencies in favor of embracing Bitcoin. “It is time for our nations to invest in Bitcoin and establish national strategic reserves,” she asserted, presenting Bitcoin as a solution to safeguard against inflationary pressures and centralized oversight.

Knafo emphasized the importance of preparing for a decentralized economic future, proposing that European nations leverage Bitcoin as a strategic financial asset. She also highlighted France’s nuclear energy capacity as an untapped resource to power Bitcoin mining infrastructure sustainably and efficiently.

Her speech included sharp criticism of the European Central Bank (ECB), accusing it of harboring “totalitarian temptations.” Knafo expressed concern that the EU’s regulatory approach to cryptocurrency—focused on taxation and excessive oversight—stifles innovation in the financial sector. Instead, she argued, Europe should champion an ecosystem that fosters freedom and decentralization.

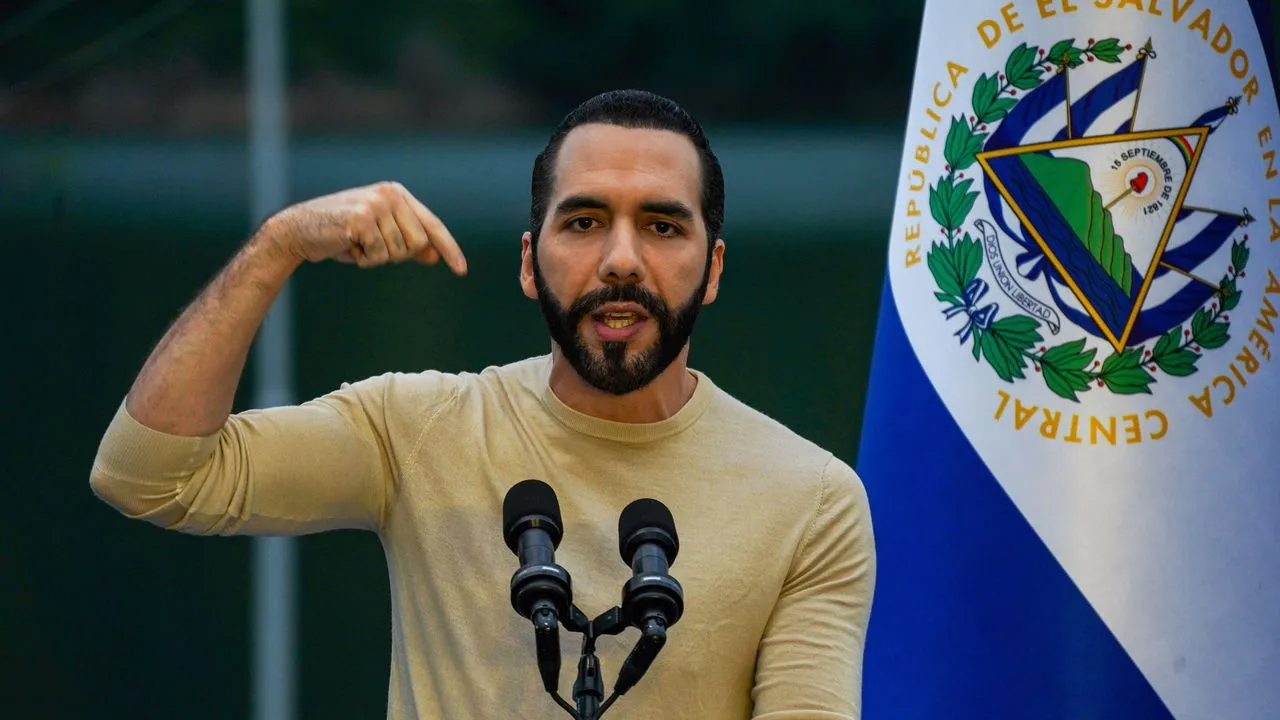

El Salvador’s President Nayib Bukele, a staunch Bitcoin advocate and the first global leader to make Bitcoin legal tender in his country, reacted positively to Knafo’s remarks. Bukele extended his “greetings” to her, signaling solidarity with her vision of decentralized financial systems.

Bukele’s pro-Bitcoin policies, which include the establishment of Bitcoin-backed bonds and investment in mining infrastructure, have sparked global debates on cryptocurrency adoption. His endorsement of Knafo’s stance amplifies her call for European leaders to consider Bitcoin as a viable alternative to centralized financial systems.

Knafo’s speech extended beyond advocacy for Bitcoin adoption. She issued a stark warning about the dangers of CBDCs, which she described as tools for government overreach and centralized control. She envisioned a dystopian future in which central banks could monitor transactions, restrict access to banking services, and erode personal freedoms.

In contrast, Knafo argued, Bitcoin offers a decentralized alternative that preserves financial autonomy and innovation. She urged lawmakers to prioritize financial independence and individual freedom over centralized digital currencies, which she sees as a threat to democratic principles.

Knafo’s appeal raises critical questions about Europe’s financial trajectory. Will the EU embrace Bitcoin and decentralization, or will it continue on its current path of implementing centralized digital currencies? Her call underscores the growing tension between innovation and regulation in the financial sector, particularly as concerns about inflation and governmental control grow.

As global leaders like Nayib Bukele lend their support to Bitcoin adoption, the movement gains momentum. Whether Europe will take this leap depends on its policymakers’ willingness to prioritize freedom, innovation, and economic resilience over the status quo.