Asset manager Bitwise, whose spot Bitcoin ETF (BITB) stands as the fifth largest in terms of Bitcoin (BTC-USD) assets under management, is making significant moves in the cryptocurrency ETF space, particularly with its Ethereum (ETH-USD) ETF. Recently, the firm revealed that it received $2.5 million in seed investment interest for this fund, with Pantera Capital expressing interest in acquiring up to $100 million in shares. However, it’s worth noting that this interest isn’t binding, which means potential buyers might choose not to purchase any shares.

Recently, the SEC approved 19b-4 forms for eight Ethereum ETFs, pushing the approval process forward. This comes after SEC Chairman Gary Gensler stated last week that he expects approvals could come this summer and mentioned that issuers are smoothly working through the process. Analysts are hopeful these ETFs could get the green light before July 4.

Is ETH Going to Boom?

It seems like today’s positive news has caused Ethereum’s price to rise almost 5% at the time of writing. Nevertheless, when using TipRanks’ technical analysis tool, the indicators seem to point to a neutral outlook. Indeed, the summary section pictured below shows that nine indicators are Bullish, compared to four Neutral and nine Bearish indicators.

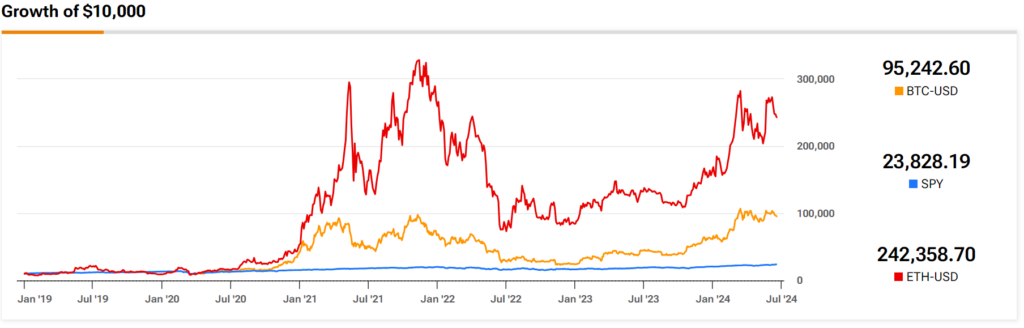

Still, Ethereum has greatly outperformed both the SPDR S&P 500 ETF Trust (SPY) and Bitcoin since 2019, according to data from TipRanks. In fact, $10,000 invested in Ethereum would be worth over $242K today compared to over $95K for Bitcoin and almost $24K for SPY, as per the image below. Although past performance isn’t indicative of future results, the fact that ETH is smaller than Bitcoin does provide it with the potential to continue outperforming.

This article was originally published by a www.tipranks.com . Read the Original article here. .