Given the massive amount of transaction data onchain and sentiment data on social media, it’s not surprising that one of the most desired areas for synergy between crypto and artificial intelligence remains AI-assisted trading.

There are already plenty of builders shipping products that aim to provide a little extra alpha to users based on a variety of signals. The quality of these products can be extremely hit-or-miss. All of them are very early! But the idea that AI products can crawl blockchains and public networks for nuggets of information to curate for its users to make trading decisions off of is a pretty convincing sell.

While many of today’s top bots are dedicated to hunting memecoin diamonds in the rough, others are working across blue-chip assets like BTC and ETH, and even in trad markets like forex.

Today, let’s examine three projects that aim to use AI to give their users a competitive edge in the market. Let’s dive in!👇

⚫️ Dither

Telegram trading bot Dither brings AI together with onchain historical data to analyze tokens for potential upside.

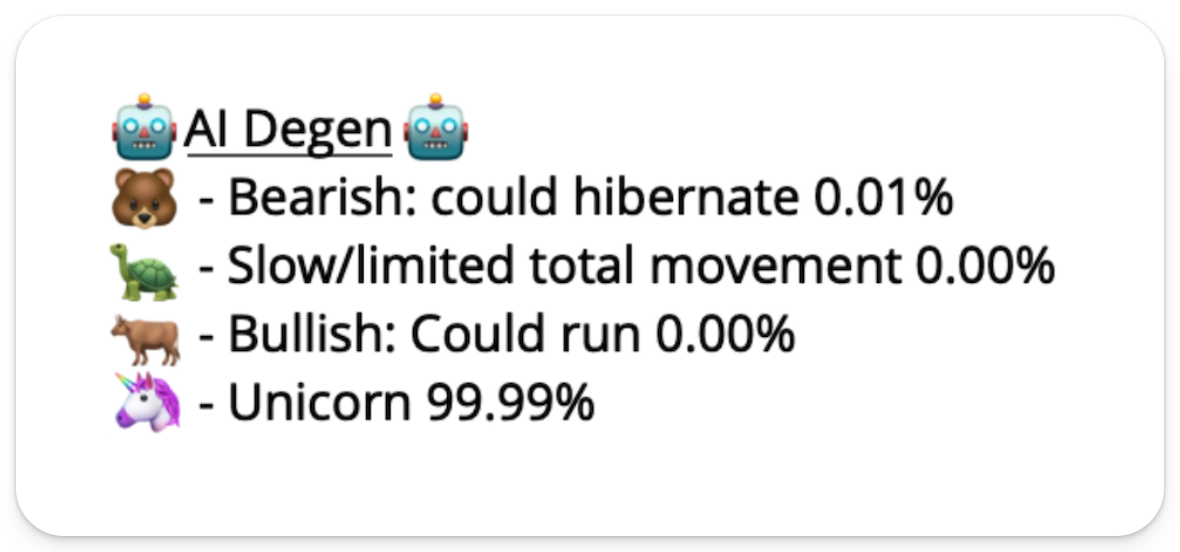

Its SeerBot uses a Time Series AI to filter for tokens matching with historically performant tokens on a number of quantitative and qualitative factors, cutting down research time for traders. The bot digs into the onchain history and ships ratings based on metrics like percent of LP locked, 24-hour volume, memeability, and holder distribution. Once the bot makes this analysis, it will assign the token an emoji-coded score with the percentage likelihood that the token will fall into each bucket.

While Dither has had some incredible wins, like finding BODEN at $233K and ALBEMARBLE at $176K, historical performance is not a guarantee of future performance, and the vast majority of its calls still end up at 0 – as most memecoins do!

↔️ Intent.Trade

The flagship product of gmAI, an “AI operating layer” on Solana, Intent.Trade applies AI to a suite of onchain activities like data analysis, automated yield farming, and, of course, memecoin trading.

Their Meme Coin Trader Agent offers tools to analyze token contract data for safety, provide chart analytics, and execute trades based on user commands via conversation with the agent. The agent provides technical analysis using data from on-chain sources to offer insights into price movement. Currently, Intent.Trade is only available to holders of a particular gmAI NFT, but they have stated the product will soon be opened up to everyone.

Someone turns 0.1 SOL into 17.2 SOL (x172 profit) using IntentTrade.

Our AI Agent spots $FLIPCAT in Solana Hot Pairs and recommends a buy signal at a 5k market cap.

Watch the magic: 5k -> 820k+ market cap (x172). pic.twitter.com/75P3ZRSd0S

— Intent.Trade (@intent_trade) June 5, 2024

🌐 Taoshi

Taoshi is a project operating a specialized Bittensor network subnet (SN8) that uses AI and machine learning to provide trading signals across forex, crypto, and indices.

Contributors on this network are skilled traders and trading systems that can submit one position (long, short, or flat) per trade pair at a time, moving in one direction until closed with a flat signal to profit. This structure ensures only the best traders and advanced trading systems compete, making Taoshi a highly competitive and efficient trading platform.

Taoshi’s network of signal providers creates a wealth of valuable indicators for trading a range of assets.

There are already a number of bots live that leverage strategies from Taoshi. One of the most popular is Timeless, a Telegram bot which provides trading signals sourced from Taoshi’s network covering forex and major crypto assets like Bitcoin and Ethereum. Timeless has plans to roll out its own automated-trading bot later this year.

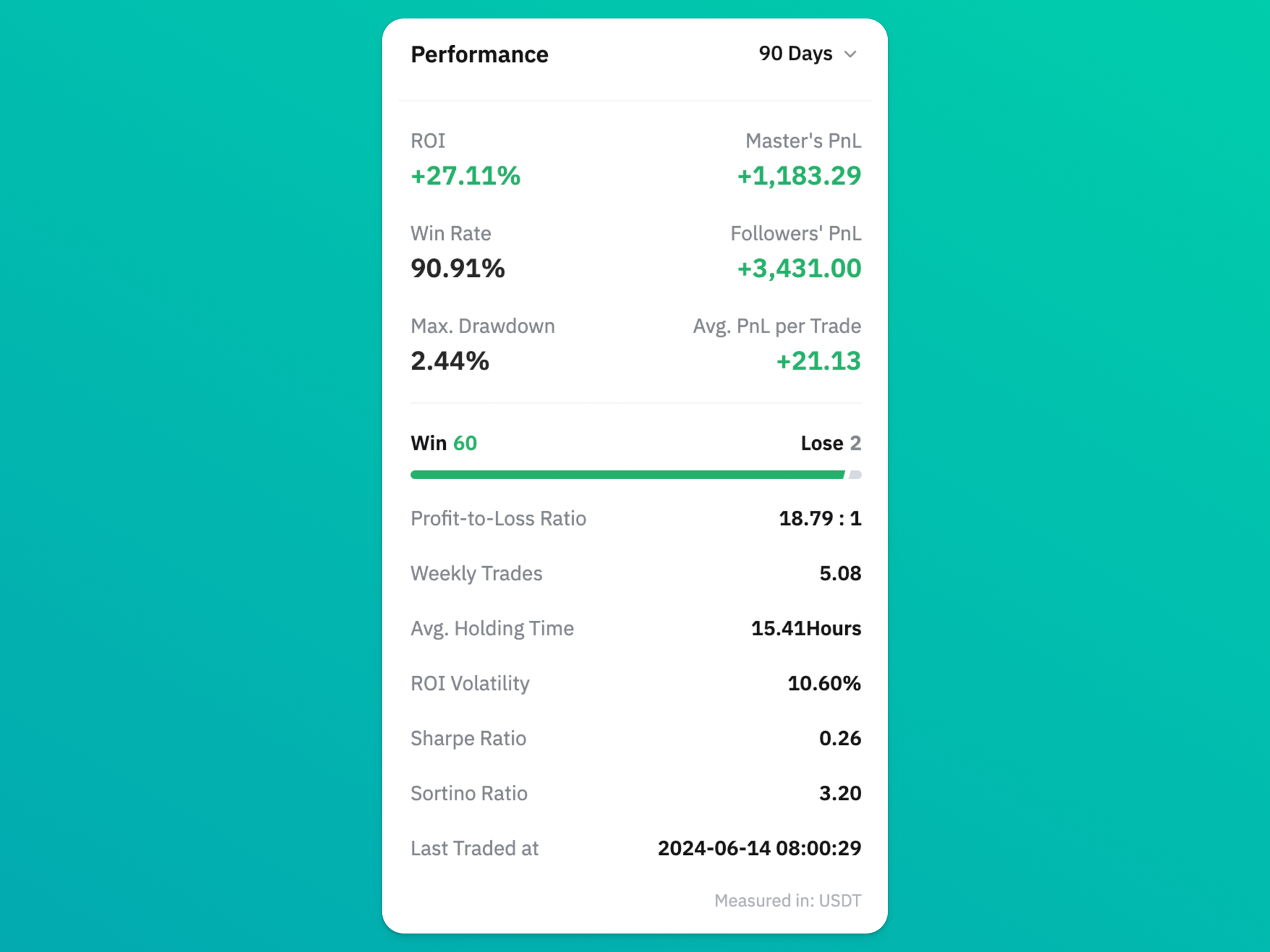

There are other AI bots to get your copy-trade fix from for now, like Dale which auto-trades on Bybit. All of Dale’s positions, past and present, can be viewed here.

Closing Thoughts

As crypto’s trading landscape evolves and grows more cutthroat, AI-driven tools are likely only going to prove more essential for gaining a competitive edge.

All of these tools are in their early innings but showing promising traction or a unique take on the future of AI-assisted trading. Together, they showcase the idea that AI support could soon become the default for retail traders, providing multiple approaches for traders to use to navigate and succeed in an increasingly competitive market.

This article was originally published by a www.bankless.com . Read the Original article here. .