(Kitco News) – Bitcoin (BTC) retested support at $69,000 in early trading on Tuesday as the characteristic volatility of pre-halving countdowns continues to dominate the market and confound derivatives traders.

Data provided by TradingView shows that after peaking at $72,800 on Monday, Bitcoin stair-stepped its way lower to support at $70,000 before a rapid selloff saw it plunge below support at $69,000 during morning trading on Tuesday, with bears now looking to flip the support level back into resistance.

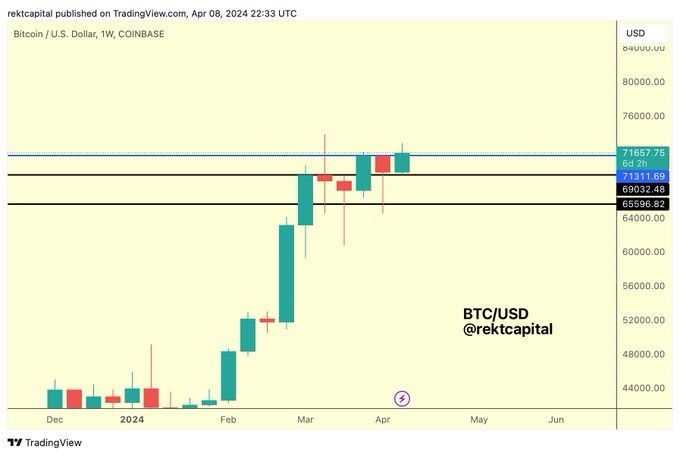

BTC/USD Chart by TradingView

Both the crypto and stock markets are now in a holding pattern as investors await tomorrow’s Consumer Price Index (CPI) reading for March to get the latest update on inflation, which could impact the Federal Reserve’s decision on interest rates.

Economists have predicted that the headline CPI reading for March will show that consumer prices rose 0.3% month-over-month, down from 0.4% in February, while the annual inflation rate is expected to rise to 3.4% from 3.2%.

Analysts have warned that the slight month-over-month decrease may not be enough to give the Fed confidence that inflation is moving in the right direction, which could further delay the highly-anticipated interest rate cuts. The CME FedWatch tool currently shows a 56% chance that the first rate cut will come in June.

With the Bitcoin halving now less than ten days away and uncertainty about interest rates top-of-mind for investors, the volatility witnessed over the past month and a half in the crypto market will likely continue for the foreseeable future.

“We’re not even halfway into April and Bitcoin has already touched a high of $72,000 and a low of $65,000,” said Neil Roarty, analyst at Stocklytics. “Investors should be gearing up for continued volatility across crypto markets, as both bulls and bears have reasons to be optimistic this month.”

“On the bullish side, the rapidly-approaching Bitcoin halving – the four-yearly event which reduces rewards for miners – has traditionally sparked pumps, while recently approved ETFs continue to drive demand,” he said.

“For the bears, the IRS’ April 15 tax payment deadline will remove liquidity from US retail, and the Fed appears to be biding its time on interest rate cuts,” he added. “High rates tend to make riskier assets like Bitcoin look less appealing.”

“In short, it wouldn’t be a surprise to see Bitcoin break one way or the other before the month is out,” Roarty concluded. “Brace for a bumpy ride.”

According to market analyst Rekt Capital, Bitcoin’s rally on Monday “confirmed a breakout from its weekly range,” and it now faces the “final resistance” at $71,300, which is its “high from two weeks ago (blue).”

“If $BTC isn’t able to break $71300 then there could be another bout of consolidation between $69000 & $71300 (black-blue),” Rekt Capital warned.

Market analyst Crypto Tony simplified the outlook moving forward, suggesting there will be volatility pre-halving, consolidation post-halving, followed by a parabolic bull run later in the year.

– Chop Chop until the #Bitcoin halving

– Consolidate post halving

– Final bull market stage pump later this year— Crypto Tony (@CryptoTony__) April 9, 2024

At the time of writing, BTC trades at $69,170, a decrease of 3.25% on the 24-hour chart.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

This article was originally published by a www.kitco.com . Read the Original article here. .