Galaxy Digital, a leader in the cryptocurrency sector, is expanding its investment scope with a recently announced $100 million fund. This venture aims to empower promising early-stage crypto startups.

The move builds on Galaxy’s existing involvement in the crypto ecosystem, which previously relied on internal capital for company investments.

Galaxy Digital’s Latest Fund to Fuel Crypto Ecosystem Growth

Known as the Galaxy Ventures Fund I, LP, the fund anticipates backing up to 30 startups within the next three years. Investments will begin at $1 million, centering on financial applications, software infrastructure, and crypto protocols.

Galaxy Digital has a solid history of investing in crypto companies, claiming to have invested $200 million in over 100 projects in the past six years. This fund, however, signifies a shift for its venture team, marking the first time they’ll engage with outside investors. The company aims to replicate the success of its balance sheet investing through an institutional-grade fund.

Read more: How To Fund Innovation: A Guide to Web3 Grants

“For years, we’ve been putting our own capital behind these innovators. Now we’re launching Galaxy Ventures Fund I LP to partner with outside investors, allowing us to continue fueling the digital asset ecosystem by backing promising early-stage companies,” the company said in a statement.

Galaxy Digital’s ambitious fund launch highlights renewed interest within the venture capital sector. Earlier this year, Marc Andreessen, Accolade Partners, and Galaxy Digital collaborated on a $75 million fund with the 1kx network. Meanwhile, Paradigm is reportedly raising between $750 million and $850 million, and Hack VC aims to raise a minimum of $100 million.

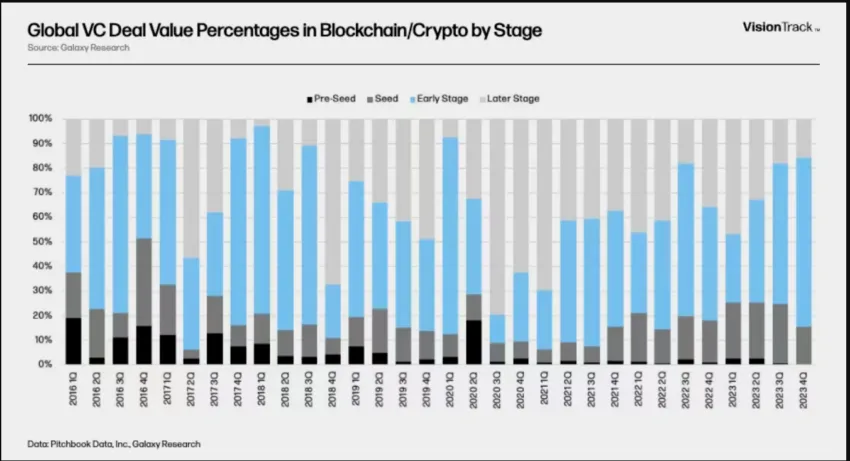

This resurgence aligns with research released by Galaxy Digital itself in January 2024. The company’s report outlined how venture fundraising strategies correlate with heightened crypto demand.

Institutional interest tends to wane as valuations decrease, posing challenges for crypto venture fundraising. This was evident throughout 2023 as passive investment products dominated the market.

Furthermore, Galaxy Digital’s report also sheds light on the significance of their new fund. Globally, venture capital firms focused on crypto/blockchain secured only $5.75 billion in 2023, a stark decline from the 2022 record of $37.7 billion.

Read more: Crypto Hedge Funds: What Are They and How Do They Work?

The company’s research emphasized that while venture fundraising within crypto wasn’t a major vehicle until 2021, the sector has still made headway compared to pre-2021 levels. The report anticipates crypto venture capital could regain momentum in 2024 if crypto-native allocators choose to reinvest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

This article was originally published by a beincrypto.com . Read the Original article here. .