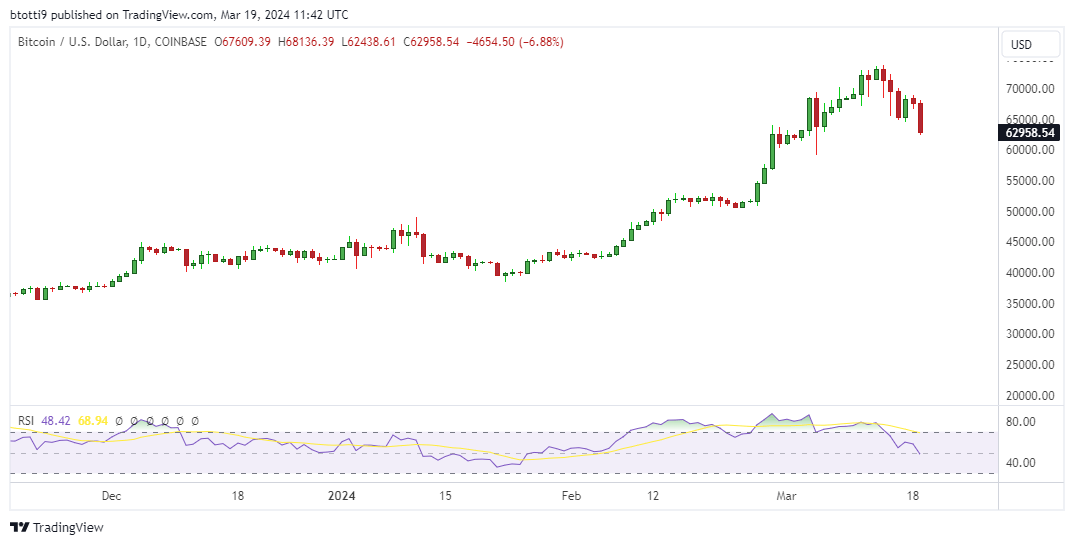

Bitcoin price tanked more than 7% on Tuesday morning as the bloodbath across the crypto market pushed altcoins deep into correction territory.

BTC reached lows of $62,438 as bears threatened to plunge prices to the $60k level.

BTC price near key level as alts bleed

As the benchmark cryptocurrency struggled, altcoin bloodbath also intensified. Ethereum, Solana, BNB, Cardano and Avalanche all fell double digits, with ETH dipping to $3,200, SOL to $172 and BNB to $502. Cardano and Avalanche dropped to $0.59 and $55 respectively.

According to data from Coinglass, a total of 242,841 traders had been liquidated in the past 24 hours (as at 7.40 am ET on Tuesday).

The total liquidations stood at over $651 million, longs the hardest hit at over $538 million and shorts at $113 million. BTC accounted for over $190 million in liquidated longs in the past 24 hours, while ETH accounted for over $126 million.

Data showed the largest single liquidation order occurred on the OKX exchange and involved the BTC/USDT-SWAP at a value of $12.25 million. Earlier in the day, a whale had dumped 400 BTC on the BitMEX exchange, plunging Bitcoin’s price to $8,900.

While prices across major exchanges remain above $60k, crypto analyst Ali suggests BTC could tank to support at $56k or even $51k. the key support level beneath current levels is $61,100, the analyst noted.

“Some of the key Bitcoin support levels to watch are $61,100, $56,685, and $51,530. On the other hand, critical resistance points for $BTC stand at $66,990 and $72,880,” Ali posted on X on Tuesday.

Some of the key #Bitcoin support levels to watch are $61,100, $56,685, and $51,530. On the other hand, critical resistance points for $BTC stand at $66,990 and $72,880. pic.twitter.com/VUjzyf2xVm

— Ali (@ali_charts) March 19, 2024

Bitcoin’s recent spike to an all-time high of $73,737 pushed its market cap to above $1.4 trillion. The flagaship cryptocurrency’s value elevated it above Meta and Silver into world’s eighth most valuable asset.

Today’s declines have pushed BTC down to 10th with a market cap of $1.23 trillion. Data shows Silver is eighth with $1.41 trillion and Meta ninth with $1.26 trillion.

Share this article

Categories

Tags

This article was originally published by a coinjournal.net . Read the Original article here. .