- The Financial Action Task Force identified countries with significant crypto activity.

- The global financial watchdog will support those countries in implementing crypto regulations.

- Getting countries to regulate crypto is an “urgent priority,” FATF’s president said.

Countries must implement regulations for crypto asset service providers soon to prevent financial crime, the Financial Action Task Force concluded at its three-day plenary in Paris this week.

Countries are not doing enough now to put into place its recommendations on preventing crime in crypto, it added.

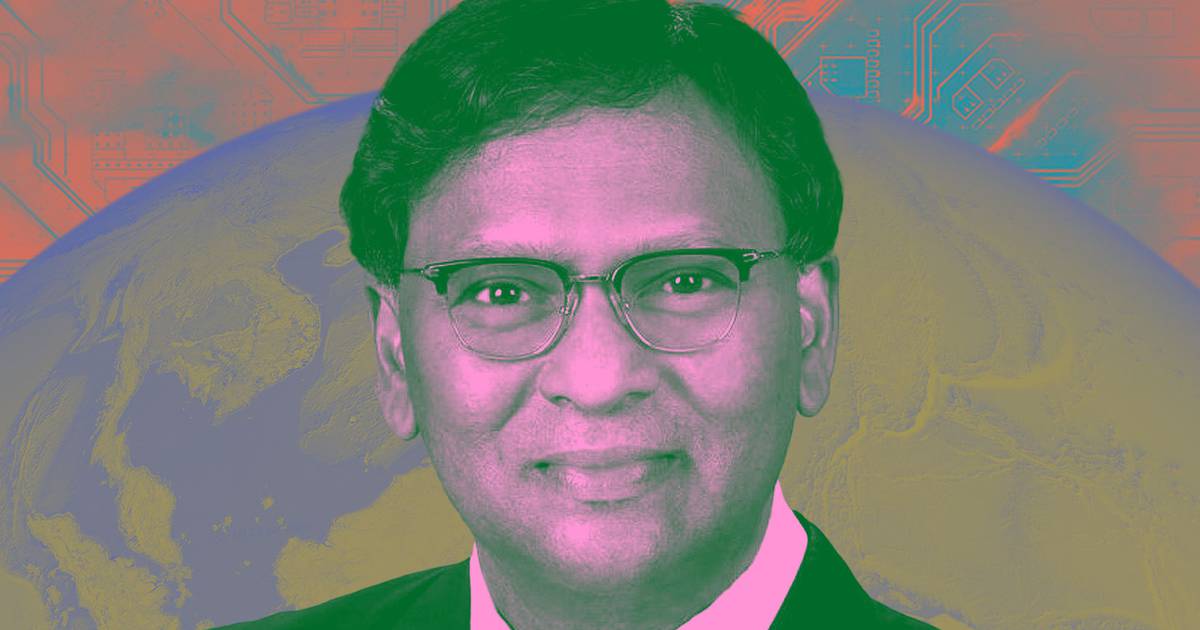

“This lack of regulation creates significant loopholes for criminals to exploit, and closing these gaps is an urgent priority of the FATF,” Raja Kumar, the president of the FATF who hails from Singapore, told reporters on Friday at a news conference.

At the plenary, the FATF identified jurisdictions with the most significant crypto activity, based on trading volume and number of users. They will receive support from FATF in implementing its recommendations.

Stay ahead of the game with our weekly newsletters

These regions include 97% of the global crypto markets, Kumar said, adding that an overview of the steps these countries needs to take is set to be published.

For crypto, the FATF has played a crucial role in shaping legislation. The international group recommends crypto service providers register with national regulators or get licenced, so that they can be monitored.

Another notable FATF policy is the “Travel Rule,” which requires that senders and receivers of crypto transfers be identified.

The FATF is pushing countries to put crypto rules against money laundering in place “without further delay,” Kumar said. “We will also continue to work with countries to ensure that they introduce regulation in this increasingly significant area.”

Join the community to get our latest stories and updates

The FATF is made up of 39 members, including the world’s largest economies, and is tasked with developing policies to prevent money laundering and financing of terrorism.

Its recommendations are being implemented as law in the European Union and in the UK.

Inbar Preiss is a Brussels-based regulation correspondent. Contact her at inbar@dlnews.com.

This article was originally published by a www.dlnews.com . Read the Original article here. .