MicroStrategy, the software firm founded by Michael Saylor and a major advocate for Bitcoin, has significantly increased its Bitcoin holdings yet again. On Monday, the company announced a new purchase of 15,350 BTC, spending approximately $1.5 billion in cash. This acquisition cements its status as one of the largest Bitcoin holders globally, while marking a major step forward for cryptocurrency adoption in traditional finance.

The company revealed that the Bitcoin was purchased between December 9 and December 15 at an average price of $100,386 per BTC. With this latest acquisition, MicroStrategy’s Bitcoin stockpile has grown to an astonishing 439,000 BTC, representing roughly 2% of Bitcoin’s total supply. This accumulation is particularly significant given Bitcoin’s limited maximum supply of 21 million coins, with approximately 19.7 million currently in circulation.

In total, MicroStrategy has spent $27.1 billion on Bitcoin, at an average cost of $61,725 per BTC. Thanks to Bitcoin’s meteoric rise this year, the company’s holdings are now valued at $45.6 billion, nearly doubling its initial investment. The price of Bitcoin has been climbing steadily in 2024, with recent gains fueled by President Donald Trump’s reelection and his administration’s pro-crypto policies. Bitcoin has broken multiple all-time highs in the past few weeks, most recently reaching $106,418.

Adding to its achievements, MicroStrategy will soon become the first Bitcoin-focused company to be included in the Nasdaq-100 Index. The Nasdaq announced the company’s addition last Friday, marking a historic moment for the cryptocurrency industry. MicroStrategy’s inclusion in the index, which features some of the world’s largest and most innovative companies, gives traditional investors indirect exposure to Bitcoin through the firm’s stock.

The company’s official entry into the Nasdaq-100 is set for December 23, before the market opens. This milestone reflects the growing recognition of cryptocurrency’s importance in the financial world and serves as validation for Bitcoin as a legitimate asset class.

Following these announcements, MicroStrategy’s stock (MSTR) saw a 3% increase in pre-market trading, reaching $422 per share, according to MarketWatch. The stock has gained popularity among Bitcoin enthusiasts and institutional investors as a proxy for gaining Bitcoin exposure without directly holding the cryptocurrency.

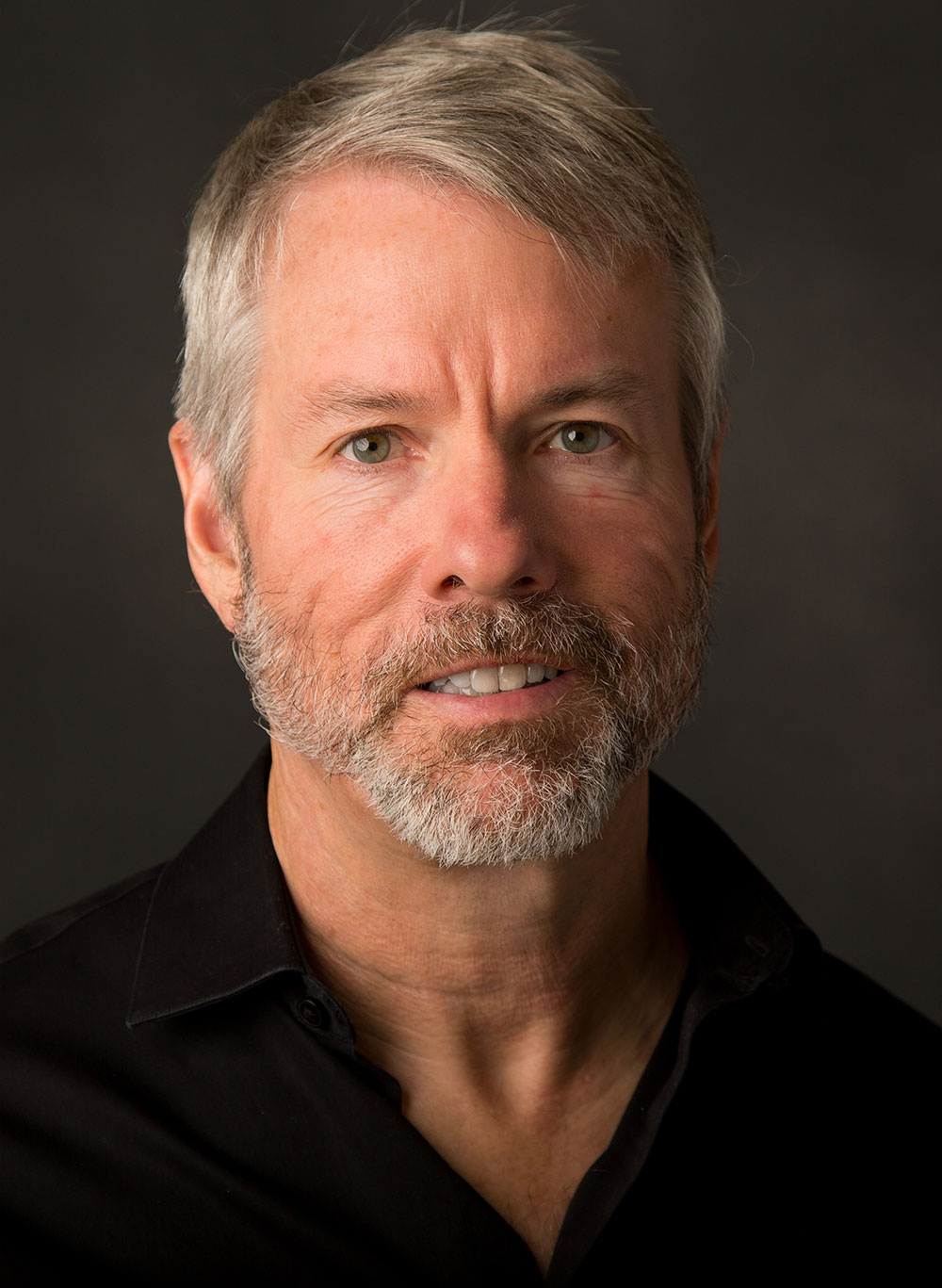

Michael Saylor’s vision for MicroStrategy has evolved far beyond its origins as a software company. By rebranding it as a “Bitcoin Development Company,” he has made it a critical player in the cryptocurrency ecosystem. MicroStrategy’s aggressive Bitcoin accumulation strategy, coupled with its integration into a major stock market index, demonstrates the growing convergence of traditional finance and the digital asset economy.

These developments highlight Bitcoin’s increasing acceptance among institutions and its growing role in mainstream financial markets. With MicroStrategy at the forefront, the line between traditional investment vehicles and cryptocurrency continues to blur, signaling a new era for the digital economy.