With the cryptocurrency markets still in an uncertain position, many crypto investors are wondering if it’s time to sell in order to secure their profits, or continue to hold, or even accumulate, to benefit from a potential price rally that could be in the store in the short to medium term.

Even though the crypto markets have always recovered from their bearish periods so far, every bear market has its “casualties” that never make a strong recovery. Therefore, it’s important to choose quality crypto projects that have a good chance of surviving the bear market and thriving in the future.

We’ve analyzed 200 of the top cryptocurrencies based on their liquidity and availability, technology, sector leadership, tokenomics and more key factors. You can read more about our criteria a bit further down in the article.

By doing so, we’ve narrowed the list down to a dozen cryptocurrencies that present the most compelling opportunities at the moment. The top three coins on our list are updated weekly to reflect the most up-to-date developments in the crypto and blockchain sector.

List of the best cryptocurrencies to invest in August 2024:

- Arbitrum – Leading Ethereum layer 2 blockchain

- Aave – Decentralized lending portocol

- Aptos – Scalable blockchain with Move smart contracts

- Bitcoin – Decentralized peer-to-peer cryptocurrency

- Ethereum – The leading blockchain for smart contracts

- Solana – High-performance blockchain platform for smart contracts

- Toncoin – A blockchain closely integrated with the Telegram messenger

- XRP – Highly efficient digital currency

- Maker – A key decentralized finance project

- Kaspa – Scalable layer1 blockchain based on BlockDAG architecture

- BNB – A popular cryptocurrency utilized in the Binance ecosystem

- Uniswap – The biggest DEX on Ethereum

Examining the best cryptos to buy right now

Let’s start off by highlighting three cryptocurrency projects that have seen important developments recently or have big events coming up in the near future. We update these highlighted coins on a weekly basis to reflect the latest developments in the world of crypto and blockchain.

Before we dive into our list of the best cryptos to buy, we should note that choosing which crypto to buy is only the first step in your crypto investment journey. It’s also important to choose the right platform to buy crypto, and you also have to decide how you will be storing your cryptocurrency.

In our opinion, the best way to invest in crypto is to transfer your coins to a hardware wallet after you buy it on an exchange. A great starting point is to buy cryptocurrency on KuCoin and store it in a Ledger hardware wallet.

1. Arbitrum

Arbitrum is a project that is creating layer 2 scalability solutions for Ethereum with the goal of giving users access to faster and cheaper transactions while still benefiting from the security of the Ethereum network.

The project’s most popular platform is Arbitrum One, which is a general-purpose layer 2 that’s based on Optimistic rollups technology. Arbitrum has also launched the Arbitrum Nova layer 2, which is optimized for applications that require a high transaction output and ultra-low transaction fees, but doesn’t provide the same level of decentralization as Arbitrum One.

The technology stack powering Arbitrum’s products is known as Arbitrum Nitro, and consists of Arbitrum Rollup, Arbitrum Orbit and Arbitrum AnyTrust.

The Arbitrum One mainnet launched in August 2022 and quickly became one of the most popular layer 2 solutions for Ethereum. The platform’s efficient transactions have allowed it to support unique decentralized applications, perhaps most notably the GMX decentralized derivatives exchange.

In addition, many protocols that made a name for themselves on Ethereum, for example Uniswap, Aave and SushiSwap, are now also deployed on Arbitrum.

Despite being a relatively recent entrant on the cryptocurrency scene, the Arbitrum platform has become one of the biggest blockchains in terms of the TVL (total value locked) in its DeFi ecosystem.

Why Arbitrum?

The Arbitrum DAO has approved a temperature check proposal which aims to increase the utility of the ARB token by implementing an ARB staking system. Under the proposed system, ARB token holders would have the ability to delegate their holdings to active governance participants and earn rewards in return.

Arbitrum governance approved ARB token staking ✅ pic.twitter.com/bOtwsIvYUm

— ethdaily.eth (@ethdaily) August 15, 2024

From a technical perspective, the proposal would introduce a liquid staked token called stARB, which would be implemented through the Tally protocol. This would give ARB stakers access to auto-compounding rewards and allow them to participate in DeFi even while staking their tokens.

Per the proposal, one of the main reasons for the STAKING proposal is the fact that the ARB token is “struggling to accrue value”. Indeed, ARB has been one of the worst performers in the cryptocurrency top 100 this year, as it’s currently posting a very disappointing -65.4% year-to-date performance.

In total, 145 million ARB tokens were used to vote in favor of the proposal, 13 million ARB token were used to vote for “Abstain”, while only around 13,000 ARB were used to vote against the proposal. This shows considerable support for introducing ARB staking, which might be just what the token needs to get out of its slump.

2. Aave

Aave is a decentralized liquidity protocol that implements a system of smart contracts that allow users to borrow crypto assets or earn interest on their holdings in a decentralized manner. Aave is essentially a set of smart contracts deployed on a blockchain, but most users will interact with the protocol through an interface such as app.aave.com.

At the time of writing, you can earn yield on about 20 different crypto assets on Aave. Usually, the assets that pay the highest yield are stablecoins such as USDT, USDP and TUSD. The yields offered by the Aave protocol depend on market demand—if there is a lot of demand for borrowing a specific crypto asset, the APY offered to suppliers of that asset will grow.

In addition, Aave offers a staking option for holders of the platform’s AAVE governance token. This is a good way for AAVE holders to earn yield while contributing to the security of the Aave protocol.

Aave was initially launched on the Ethereum blockchain, but is now also available on other blockchain platforms such as Avalanche, Optimism, Polygon and Arbitrum.

Why Aave?

The Aave protocol has recently reached an all-time high in active weekly borrowers, despite recent sideways movement in the markets for the largest cryptocurrencies. According to an X post from on-chain analytics group Sealaunch, this recent growth has been driven from layer 2 platforms, particularly Base, Scroll and Arbitrum.

Interesting to see Aave user growth (borrowers) coming from L2s (Base, Scroll, Arbitrum) in the last weeks. https://t.co/OEvc3a4N3M

— sealaunch.xyz (@sealaunch_) August 14, 2024

In addition to the fact that Aave has hit a new ATH in weekly borrowers, Aave founder Stani Kulechov also pointed out that Aave is close to reaching an ATH in total weekly depositors as well.

Another recent positive development for Aave is that the protocol is slated to launch on ZKsync, an Ethereum layer 2 which is powered by ZK (zero-knowledge) rollup technology. In a recent governance vote to activate the Aave v3 protocol on ZKsync, 778,000 AAVE tokens were used to vote infavor of the proposal, and no votes were cast gainst the proposal.

The AAVE token is up 19% in the last 7 days, which is the second-best performance among the top 100 largest crypto assets by market capitalization.

AAVE has also displayed impressive resilience in the medium term, gaining 12.1% in the last three months while both Bitcoin (-18.2%) and Ethereum (-29.7%) displayed significant losses in the same time frame.

At the time of writing, Aave is the third-largest decentralized finance protocol in terms of TVL (total value locked), with more than $11.4 billion worth of assets deposited in the protocol.

3. Aptos

Aptos is an innovative layer 1 blockchain platform that is both highly scalable and secure. This platform adopts a modular structure, simultaneously handling various transaction-related elements like metadata sequencing, execution of transactions, and grouped data storage. Following multiple incentivized test phases, the Aptos mainnet was successfully launched in October 2022.

The team behind Aptos has its roots in Diem, a blockchain-based stablecoin initiative started by Facebook in 2019, which was eventually shelved due to regulatory issues. Aptos is built using Move, a programming language tailored for smart contracts that emphasizes security. This language equips developers of decentralized applications with tools to avoid the typical issues found in the smart contract languages of the current generation.

Thanks to its scalable technological foundation, the Aptos blockchain is able to offer very low transaction fees and provide impressive transaction throughput.

Why Aptos?

Leading stablecoin issuer Tether has announced that its flagship USD-pegged token USDT will be launching on the Aptos blockchain.

Tether (USD₮) To Launch on Aptos Blockchain

Learn more: https://t.co/oAZcqa5RRv pic.twitter.com/0Mp7Lwm82b— Tether (@Tether_to) August 19, 2024

In their announcement, the Tether team highlighted the Aptos blockchain’s speed and scalability, and also noted a substantial increase in daily Aptos users since the start of 2024. The average daily active user count on the platform increased from 96,000 in January to 170,000 in July.

Tether CEO Paolo Ardoino had the following to say on the integration with Aptos:

“Aptos’ innovative technology offers a solid platform for facilitating faster and more cost-effective transactions with USDT. This collaboration underscores our ongoing efforts to lead with innovation and support our users with stable, reliable financial tools.”

In addition to USDT, another key integration that could be coming to the Aptos ecosystem is a potential launch of DeFi heavyweight Aave on the Aptos blockchain. In July, the Aptos Foundation published a proposal to deploy Aave v3 on the Aptos mainnet. If successful, this would be Aave’s first deployment on a blockchain that is not compatible with the EVM (Ethereum Virtual Machine).

At the time of writing, APT is the 31st largest crypto asset by market capitalization thanks to a valuation of $2.5 billion. The token’s recent performance has left a lot to be desired, as APT is down about 20% against the US dollar in the last month.

4. Bitcoin

Bitcoin is a decentralized peer-to-peer cryptocurrency that was initially described in 2008 and launched in early 2009. Bitcoin was invented by a person using the pseudonym Satoshi Nakamoto, whose real identity is still unknown.

Bitcoin introduced the concept of a blockchain and provides a fully decentralized digital currency that’s extremely secure. It implements Proof-of-Work to make it very difficult to alter the history of transactions or double spend coins. The network is secured by miners, who are rewarded with BTC coins for adding blocks to the Bitcoin blockchain.

BTC can be sent anywhere in the world on a 24/7 basis, and transactions cannot be blocked by any intermediaries. By holding their own private keys, users can self-custody their Bitcoin without requiring institutions such as banks.

Even though countless cryptocurrencies and blockchain platforms have been released after Bitcoin, BTC is still easily the largest cryptocurrency by market capitalization.

Why Bitcoin?

Bitcoin continues to be the most important cryptocurrency to watch as the $60,000 price level has been highly contested in the markets. Over the weekend, the bears took charge as the price of the world’s leading digital asset slipped to $58,000, which is currently acting as a support level.

Still, the week was positive overall for Bitcoin, with BTC gaining 11.1% over the 7-day period. Bitcoin displayed a powerful bounceback from the $49,700 low, which was reached amidst turmoil in the stock markets.

Despite the rally last week, Bitcoin is not out of the woods, as the BTC price is still far from the $69,800 peak reached at the end of July. According to data from Farside Investors, spot Bitcoin ETFs saw $167 million worth of outflows in the last week, which is an interesting data point given that the price of Bitcoin had been increasing throughout the week.

On-chain analytics platform Lookonchain noted that cryptocurrency exchanges had stopped receiving USDT from the Tether Treasury towards the end of the week, which indicates that demand from institutional investors has calmed down after a large number of USDT tokens was sent to exchanges earlier in the week.

Institutions seem to have temporarily stopped buying, and the price of $BTC dropped 4.5% today!

We noticed that institutions stopped receiving $USDT from #TetherTreasury and transferring it to exchanges 2 days ago.https://t.co/0XKiPmjJed pic.twitter.com/NRFkp4Vqan

— Lookonchain (@lookonchain) August 12, 2024

5. Ethereum

Ethereum is a blockchain that supports smart contracts, enabling more complex use cases such as decentralized lending protocols and non-fungible tokens. The Ethereum project was founded by Vitalik Buterin, who published the Ethereum whitepaper in late 2013. The Ethereum blockchain launched in July 2015.

One of the first use cases enabled by Ethereum that gained a lot of traction was the ability to issue custom tokens that could be transacted over the Ethereum blockchain. This feature was utilized by many projects to conduct fundraising through Initial Coin Offerings (ICOs) and other types of token sales.

Today, Ethereum has an extremely vibrant ecosystem of decentralized applications – including decentralized financial services, NFT marketplaces, publishing platforms, decentralized cryptocurrency exchanges, and more – which makes it a good investment in 2023, in our opinion.

ETH is the native asset of the Ethereum blockchain, providing an incentive for users to secure the network. The Ethereum network originally implemented a Proof-of-Work consensus mechanism but switched over to Proof-of-Stake in September of 2022.

Why Ethereum?

With Ethereum ETFs expected to start trading in the US market soon, ETH is certainly among the most interesting crypto assets to keep an eye on in the short term.

After the SEC’s approval of 19b-4 filings from exchanges that are looking to list Ethereum ETFs, ETH saw a substantial rally that took the ETH price to roughly $3,900. Since then, the price has dipped into the $3,000 range. However, once ETFs actually start trading, we could see another doze of bullish activity take over the ETH markets.

Remember that the first Bitcoin spot ETFs started trading in the US just earlier this year. When they first launched, BTC was trading at about $45,000. However, in the days and weeks following the launch, BTC shot up all the way to a new all-time high above $73,600.

While it’s impossible to say whether spot ETFs will have the same outsized impact on ETH as they did on BTC, it’s difficult not to be at least somewhat optimistic about the whole thing. According to the latest news coming from Bloomberg analysts, the SEC could approve Ethereum spot ETFs for trading on July 15th.

6. Solana

Solana is a smart contracts platform with a unique architecture that allows it to process thousands of transactions per second while keeping costs extremely low. Solana achieves this by utilizing a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL is among the cheapest cryptos to transfer on the market, as users pay less than $0.001 per transaction on average.

Solana was founded in 2018 by Anatoly Yakovenko. The platform’s mainnet launched in March 2020 and saw a huge boost in adoption in 2021. While SOL has lost a lot of its value in the 2022 bear market, Solana still has one of the most impressive ecosystems in the cryptocurrency sector and is potentially still one of the next cryptos to explode.

Why Solana?

Solana has been on a tear lately, recording a 55% price increase since early July. Several factors have contributed to its impressive performance over the past couple of weeks, including growing speculations around a Solana spot ETF.

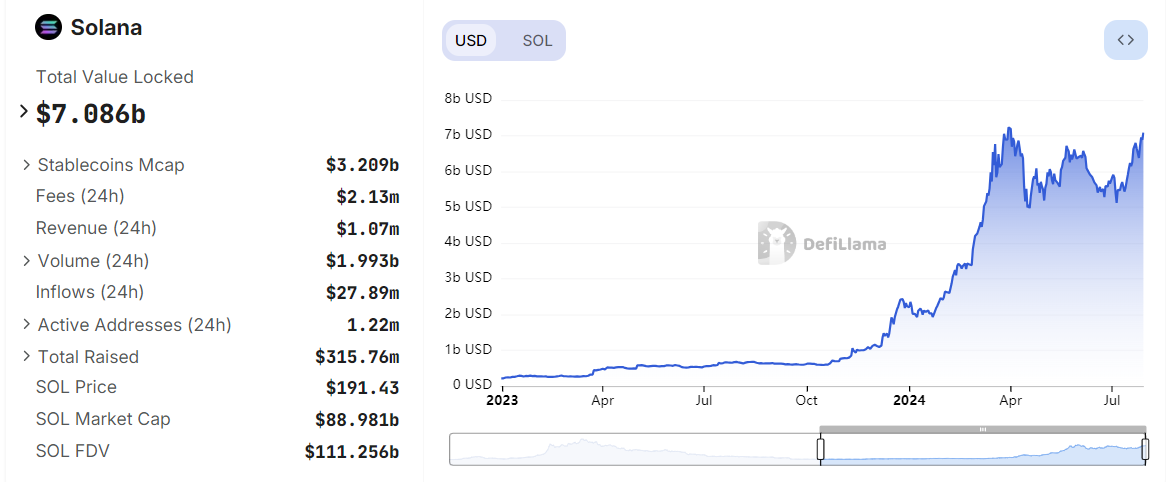

One notable metric that supports the fact that Solana’s bullish activity is not purely driven by speculation is the increase in network activity. According to data from Dune Analytics, the total number of active addresses on Solana increased from 830,000 in early July to 1,290,000 in late July. Moreover, the total value locked increased to $7.1 billion, up from $2.3 billion at the start of the year.

Source. DeFi Llama

There have been two separate applications to launch a spot Solana ETF in the United States, coming from asset management firms VanEck and 21Shares. Both applications are seeking to get the products listed on the CBOE BZX exchange.

21Shares plans to use Coinbase as the fund’s SOL custodian, with the funds being stored in segregated wallets on the Solana blockchain. Notably, the fund will not be staking SOL, likely due to regulatory requirements.

Outside of the United States, 21Shares already offers an ETP (exchange-traded product) that is 100% physically backed by SOL. The product also gives holders access to staking yields. The product, which has the ticker ASOL, trades on the SIX Swiss Exchange, Boerse Stuttgart, and Euronext Amsterdam stock exchanges.

While the fact that there are now active Solana ETF applications is bullish for SOL overall, the path to a Solana ETF might be more difficult than what we’ve seen with the recently approved Ethereum ETFs.

It’s important to note here that U.S. securities regulator SEC has already claimed that SOL is an unregistered security in at least two lawsuits. Meanwhile, U.S. regulators largely treat Bitcoin and Ethereum as commodities. Another factor to consider is that, unlike Bitcoin and Ethereum, there is no regulated Solana futures market in the United States.

7. Toncoin

Toncoin is a blockchain project that’s continuing the development of a blockchain platform that was initially designed by the team behind the Telegram messenger. While Telegram was forced to abandon the project due to legal trouble with securities regulators in the United States, community members saw potential in Telegram’s blockchain vision and resumed development under the name Toncoin.

The development of Toncoin is led by an organization called the TON Foundation, which has no formal association with Telegram. However, the Telegram team is integrating various solutions powered by the Toncoin blockchain into their messenger. For example, the Telegram app now allows users to access the TON Space wallet.

From a technical perspective, Toncoin is a scalable blockchain with smart contracts functionality and a Proof-of-Stake consensus mechanism. However, the initial distribution of TON was performed through a Proof-of-Work model to ensure a fair launch.

Why Toncoin?

The world’s leading cryptocurrency exchange Binance has finally listed Toncoin spot markets after previously only offering trading for TON through futures contracts. Traders are now able to access TON on Binance through trading pairs against BTC, USDT, FDUSD and TRY.

Interestingly enough, Binance has applied the “seed tag” to Toncoin, despite TON currently being the 8th largest crypto asset by market capitalization. The seed tag is usually applied to newer cryptocurrency projects that Binance believes “might exhibit higher volatility and investment risks when compared to other listed tokens”.

Despite this, users can trade tokens which have the seed tag if they pass quizzes which ensure that they are aware of the risks of trading cryptocurrencies.

The Binance listing has helped provide some momentum to Toncoin, as TON is up 24.3% in the last 7 days.

In other Toncoin-related news, a new app called Signer now allows Toncoin users to improve the security of their holdings by storing and using their private keys outside of their Toncoin wallet. Users can choose between a convenience mode in which the Signer app can be paired with the Tonkeeper wallet, or alternatively use QR codes to sign transactions offline for maximum security.

Introducing Signer!

Developed by @tonkeeper, Signer is a new app that enhances the security of your transactions by allowing you to securely store and use private keys outside of your wallet. 🔐

Choose between convenience mode, pairing Signer with Tonkeeper on a single device,… pic.twitter.com/IIYk5A6cAN

— TON 💎 (@ton_blockchain) August 9, 2024

8. XRP

XRP is a cryptocurrency that was launched in June of 2012. It was developed by David Schwartz, Jed McCaleb and Arthur Britto, who started a company called OpenCoin together with Chris Larsen. 80% of the XRP supply was gifted to the company by the developers of XRP. OpenCoin has since been renamed to Ripple, and the company has put the majority of its XRP holdings into escrow.

XRP provides very fast and low-cost transfers, making it suitable for use-cases like remittances. It uses neither Proof-of-Work nor Proof-of-Stake, but instead implements the XRP Ledger Consensus Protocol. Every participant in the XRP network can choose a set of validators that they trust to behave honestly.

Ripple has implemented the XRP cryptocurrency into its products, most notably On-Demand Liquidity (ODL). ODL works in partnership with cryptocurrency exchanges uses XRP to provide efficient cross-border money transfers.

Why XRP?

Fintech company Ripple has announced that it will invest $10 million into tokenized treasury bills (T-bills) on the XRP Ledger. The tokens are backed by short-term US Treasury bills and reverse repurchase agreements, which are supported by US Treasuries.

News alert – tokenization platform @OpenEden_Labs is bringing tokenized US Treasury bills (T-bills) to the #XRPL! What’s more, Ripple is creating a fund to invest in tokenized T-bills, and will allocate USD$10M to OpenEden’s TBILL tokens as part of it. https://t.co/8GsG1Mk3ER

— RippleX (@RippleXDev) August 1, 2024

The tokenization of T-bills on the XRP Ledger is enabled by OpenEden, a platform designed for the tokenization of real-world assets (RWAs). In addition the to XRP Ledger, the platform also supports the tokenization of RWAs on the Ethereum and Arbitrum One blockchain platforms. At the time of writing, OpenEden’s T-bill Vault has a total value locked of $91.7 million and an estimated APY of 4.95%.

According to Ripple, the $10 million investment is part of a larger fund that will make allocations into tokenized treasury bills on OpenEden and other tokenization platforms. RippleX senior vice president Markus Infanger had the following to say about the purchase of T-bills on OpenEden:

“Institutions are increasingly looking at where to tokenize their real-world assets and the arrival of T-bills on the XRPL powered by OpenEden reinforces the decentralized Layer 1 blockchain as one of the leading blockchains for real-world asset tokenization.”

Per OpenEden co-founder Jeremy Ng, users will be able to buy tokenized treasury bills on OpenEden using the Ripple USD stablecoin after it launched later in 2024.

9. Maker

Maker is a decentralized finance protocol on the Ethereum blockchain that issues and manages Dai, a decentralized stablecoin pegged to the US dollar. Users that hold assets that are supported as collateral (for example, ETH) can lock their coins into Maker’s smart contracts in order to issue Dai.

The system is overcollateralized—in order to mint Dai, users need to provide collateral that exceeds the value of minted Dai, and users are required to monitor the value of their collateral in order to avoid liquidation.

The MKR token is used as the governance token for the MakerDAO, a decentralized autonomous organization that oversees the Maker protocol.

MakerDAO was founded in 2014 by Rune Christensen, and the Dai stablecoin was launched in late 2017. Initially, the Maker protocol only supported ETH as collateral. With the launch of Multi-Collateral Dai in 2019, it also became possible to use other forms of collateral. Today, Dai is backed by a diverse range of assets, including ETH, (wrapped) BTC, USDC, USDP, and many others.

Why Maker?

MakerDAO has announced the Spark Tokenization Grand Prix, an open competition in which $1 billion will be invested into tokenized RWAs (real-world assets) through the Maker platform. More specifically, the campaign is being organized by Spark, a lending platform that operates a smaller sub-DAO within MakerDAO.

The Spark Tokenization Grand Prix has just been officially announced.

Take part in shaping the mission to onboard $1 billion in tokenized real-world assets to MakerDAO.

Follow @sparkdotfi and read the thread below for more information. https://t.co/w3O9y7OypR

— Maker (@MakerDAO) July 11, 2024

According to reports, numerous significant players are lining up to participate in the program, including BUIDL, a tokenized treasury fund launched by asset management giant BlackRock. Other likely participants include Superstate and Ondo Finance.

Carlos Domingo, the CEO of tokenization platform Securitize, which serves as the issuance partner for BlackRock’s BUIDL fund, had the following to say:

“We think this is a very good move from MakerDAO and we are excited to participate with Blackrock’s BUIDL. As the leading tokenized treasury issuer, we will certainly apply.”

10. Kaspa

Kaspa is a decentralized cryptocurrency project focused on high scalability and fast transactions. Utilizing a blockDAG rather than a traditional blockchain, Kaspa aims to offer fast block confirmations for a more efficient and user-friendly experience.

The layer-1 blockchain makes GPU mining processes more efficient, combining a proof-of-work (PoW) consensus mechanism with a DAG (directed acyclic graph) to optimize block finality. This makes the Kaspa network more efficient than alternative PoW chains, not just in terms of energy expenditure for miners, but also in terms of processing transactions.

Why Kaspa?

Kaspa was one of the best cryptocurrency performers last week, gaining 19.5% against the US dollar in the seven-day period.

Arguably the biggest catalyst for this growth was the news that cryptocurrency mining firm Marathon Digital announced that it had been mining Kaspa since September 2023.

The company has purchased 60 petahash worth of Kaspa mining hardware (Bitmain’s KS3, KS5, and KS5 Pro miners), although only half of Marathon Digital’s Kaspa miners are operating at the moment. The firm estimates that it will have 16% of Kaspa’s global hashrate once all its Kaspa mining hardware is deployed.

For even more context on Kaspa, as well as how we continue to support Bitcoin and proof-of-work ecosystems, read our blog for more details: https://t.co/6MxgVxowEa

— MARA (@MarathonDH) June 26, 2024

Marathon cited Kaspa’s “fair launch, technology and strong market position” as the main reasons why they decided to start mining it in addition to Bitcoin. The company also said that diversification of its digital assets portfolio was a key reason for launching Kaspa mining operations. It’s worth noting that KAS is the most profitable crypto to mine as of July.

Marathon Digital’s chief growth officer Adam Swick stated:

“Integrating Kaspa into our digital asset compute portfolio enables us to diversify our revenue streams and improve our profitability per kilowatt-hour. Bitcoin is Bitcoin, and nothing will ever take away its unique value proposition. However, Kaspa’s innovative technology and dedicated community present a valuable opportunity for us to support and nurture proof-of-work innovation.”

11. BNB

BNB is a token that was launched by the Binance cryptocurrency exchange in 2017. BNB serves two primary functions. Holders of the token get access to special benefits when using Binance – this includes lower trading fees, access the exchange’s Launchpad and Launchpool programs, cashback on Binance Visa card purchases, and more.

The token is also used as the native asset of the BNB Chain blockchain. BNB Chain is a variant of Ethereum that offers significantly lower transaction fees to users, and it allows developers to easily deploy EVM-compatible decentralized applications. Previously known as Binance Coin, BNB has now gone through an extensive rebranding.

Why BNB?

The Binance cryptocurrency exchange recently announced a new initiative called “HODLer Airdrops”, which will provide airdrops to users who have their BNB tokens in Binance’s Simple Earn lending products.

According to Binance, the tokens that will be airdropped through HODLer Airdrops will be sourced from projects that already have a large circulating token supply and will soon be listed on Binance. The exchange says it will be prioritizing “small to medium projects with strong fundamentals, a large circulating supply, and strong and organic communities”.

HODLer Airdrops will apply to BNB holders who have their tokens in Simple Earn products, including flexible and locked lending products. The airdrop allocations will be determine according to each user’s hourly average balance in Simple Earn, and Binance will also be taking historical snapshots of users’ Simple Earn BNB balances at randomly selected intervals.

The HODLer Airdrops initiative is yet another incentive for users to hold BNB tokens, as BNB tokens committed to Simple Earn products will also be eligible for other benefits such as Launchpool and Megadrop initiatives, as well as Binance’s VIP program.

12. Uniswap

Uniswap is a decentralized cryptocurrency exchange that introduced and popularized the AMM (automated market maker) model. This unique design removes the need for order books, providing an elegant way for swapping between different tokens directly on the blockchain without relying on intermediaries.

The Uniswap protocol is decentralized, and anyone can create liquidity pools for any token. This means that the newest crypto assets are often traded on Uniswap before they make their way on centralized cryptocurrency exchanges.

The model introduced by Uniswap has been adopted by many decentralized exchanges on different blockchain platforms. However, Uniswap remains the most active decentralized exchange in terms of trading volume.

Uniswap is governed by holders of the UNI token, who can submit and vote for proposals. UNI was distributed to past users of the Uniswap protocol via an airdrop in 2020, and the token is now available for purchase on a variety of both decentralized and centralized trading platforms.

Why Uniswap?

Uniswap’s governance token UNI has been the best performer among the top 100 cryptocurrencies in the past week, recording a +12% price 12. This surge has helped UNI reach a new multi-week high during a period where the overwhelming majority of cryptocurrencies lost value.

On-chain data reveals that UNI’s price increase coincided with promising market trends. The open interest for UNI peaked at $168 million earlier in June, up from $85 million a month ago, indicating growing investor interest. While this does not guarantee that UNI will continue to rise in value, it suggests that investors are optimistic about its prospects.

On June 14, Uniswap announced support for ZKsync, enabling trades on the highly efficient Ethereum layer 2 network. This integration promises lower fees and faster transaction times for Uniswap users, potentially contributing to the recent positive sentiment around UNI.

You asked. We answered.

ZKsync is now live on the Uniswap interface 🔄 pic.twitter.com/fIZscDTe8b

— Uniswap Labs 🦄 (@Uniswap) June 14, 2024

| Native asset | Launched in | Description | Market cap* | |

|---|---|---|---|---|

| Arbitrum | ARB | 2022 | Leading Ethereum layer 2 project | $1.43 billion |

| Aave | AAVE | 2020 | Decentralized lending protocol | $1.63 billion |

| Aptos | APT | 2022 | Scalable blockchain with Move smart contracts | $2.6 billion |

| Bitcoin | BTC | 2009 | Decentralized peer-to-peer cryptocurrency | $1.16 trillion |

| Ethereum | ETH | 2015 | The leading blockchain for smart contracts | $312 billion |

| Solana | SOL | 2020 | High-performance blockchain for smart contracts | $64.9 billion |

| Toncoin | TON | 2021 | A blockchain closely integrated with the Telegram messenger | $23.7 billion |

| XRP | MATIC | 2012 | Highly efficient digital currency | $32.1 billion |

| Maker | MKR | 2015 | A key decentralized finance project | $1.79 billion |

| Kaspa | KAS | 2021 | Scalable layer1 blockchain based on BlockDAG architecture | $3.81billion |

| BNB | BNB | 2017 | BNB Chain’s native asset and token used in Binance ecosystem | $79.71 billion |

| Uniswap | UNI | 2020 | The biggest decentralized exchange protocol | $3.71 billion |

*Data as of August 19, 2024, at 12:20 UTC.

Best crypto to buy for beginners

If you’re a new entrant in the cryptocurrency space, it’s probably best to stick to cryptocurrencies that have been around for a longer period of time and have a well-developed ecosystem of resources for users. This will make it easier for you to set up your wallet and find answers if you encounter any problems along the way.

If you’re a beginner, consider sticking to cryptocurrencies that satisfy the following criteria:

- The coin has a significant market capitalization ($1 billion and up)

- The coin is listed on many cryptocurrency exchanges and can easily be exchanged against fiat currencies

- The coin has solid liquidity (at least $100 million in 24-hour trading volume)

- The coin is already a working product and is not based on future promises

If you stick to coins that meet these criteria, you’ll automatically be filtering out a lot of low-quality projects and reducing your chances of falling victim to scams. You will also easily be able to sell your coins and convert them to fiat currency if you ever decide to do so.

Here are a few examples of cryptocurrencies that are worth considering for beginner investors in crypto. These coins have a lot of liquidity, well-developed ecosystems and a lot of educational resources and tools that will help beginners get up to speed.

Please note that cryptocurrencies are risky investments and typically display a lot of price volatility. This is true even for established cryptocurrencies with multi-billion dollar market capitalizations. Never invest more than you are willing to lose.

Best crypto to buy for long-term investors

Many crypto investors prefer to passively hold their cryptocurrencies over the long term instead of actively trading them. Frankly, this is a good decision if you don’t want to put a lot of time and effort into following everything that’s happening in the crypto and blockchain space.

If you’re trying to invest in crypto for the long term, we recommend that you only stick to the most established cryptocurrencies such as Bitcoin and Ethereum. While they are still risky, their fundamentals are much more robust than projects that heavily depend on just a few developers and community leaders.

In order to invest in crypto successfully over the long term, we recommend that you store your coins safely using a hardware crypto wallet. Although there are plenty of high-quality hardware wallets out there, Ledger’s devices stand out as the best choice overall, in our opinion.

How we chose the best cryptocurrencies to buy

With thousands of different cryptocurrencies on the market, it can be challenging to narrow down the list to only about a dozen coins. When creating this list, we aimed to showcase a variety of cryptocurrency projects, ranging from well-established projects to more speculative projects that could potentially have a lot of upside. Here are the factors we considered when deciding which cryptocurrencies to feature.

Availability

It’s important for a cryptocurrency to be easily available across a variety of cryptocurrency exchanges, including both centralized and decentralized options. We also considered whether the cryptocurrency can be traded directly against fiat currencies, which makes the process of buying and selling much more straightforward.

Market capitalization

The coins featured on our list of the best cryptocurrencies to buy in 2023 are all among the 100 largest crypto assets by market capitalization. By itself, a large market capitalization doesn’t mean that the project is of high quality. However, it is a good indication that there’s a lot of community interest in the project, and coins with a larger market cap are more resilient to market manipulation attempts, as moving the market requires large amounts of capital.

Sector leadership

The cryptocurrency market can be divided into several sectors. For example, we have Proof-of-Work cryptocurrencies and Proof-of-Stake cryptocurrencies, which represent two of the main approaches towards achieving decentralized consensus. We can further identify other sectors such as decentralized finance, non-fungible tokens, layer 2 projects, meme coins and others.

We attempted to highlight projects that are leaders in their respective sectors in order to showcase the variety that can be found in the crypto and blockchain space.

Working products

It’s important that the cryptocurrency we’re featuring has a working product already and isn’t simply based on future promises. When it comes to cryptocurrencies, we generally avoid highlighting coins that don’t have a working mainnet yet. When it comes to tokens, we try to focus on tokens that are used as utility tokens in a working product or as governance tokens in an actively used decentralized protocol.

Occasionally, we will highlight coins that are about to launch their mainnet or key product soon. However, we try to limit this only to top-tier projects that are highly anticipated by the crypto community.

Team and development

Most high-quality crypto and blockchain projects are transparent about their team and their credentials. We prefer to highlight projects developed and managed by highly qualified individuals. In addition, we put a lot of value on activity. If a project is being developed actively, we’re much more likely to feature it over a project that is only improved occasionally.

Of course, a project’s team or founders being anonymous is not a dealbreaker in every single case. After all, we still don’t know who created Bitcoin.

The bottom line: What crypto to buy now?

What is the best crypto to buy now is mostly dependent on your own individual risk profile and investment goals. If you are interested in cryptocurrencies that have long-term potential, then staples like BTC and ETH are probably the right choice for you.

If your risk appetite is greater, you can try to pursue investments in cryptos under 1 cent or participate in the latest crypto presales if you are feeling especially frisky.

In any case, please keep in mind that the cryptocurrency market is highly volatile and that investing in cryptocurrency is subject to considerable risk. Always do your research and consider your financial situation before making any investment, and never invest more than you are willing to lose.