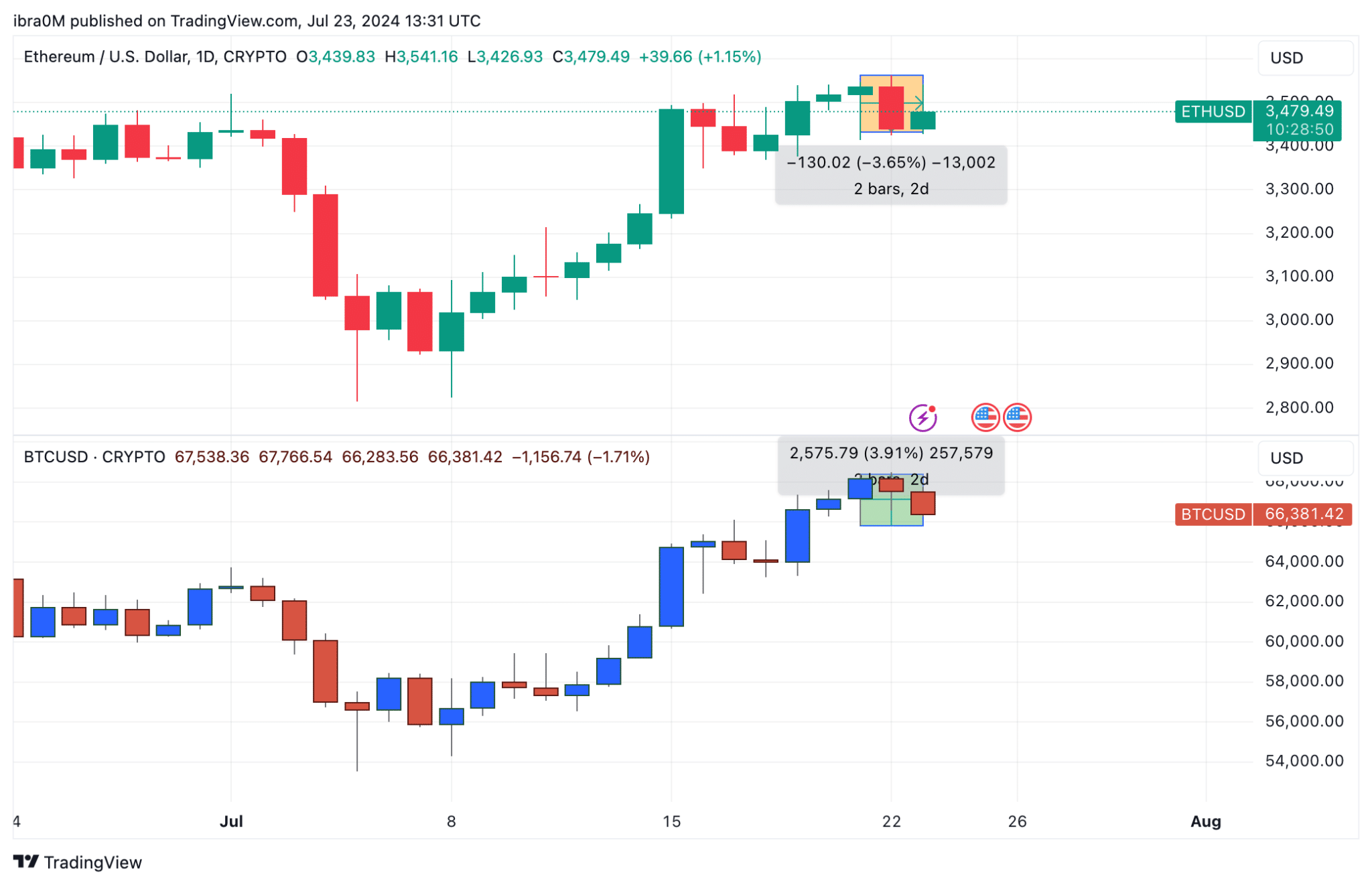

Ethereum’s price has consolidated within the $3,400 – $3,550 narrow channel over the last four trading days as bull traders take on a cautious outlook ahead of the spot ETH ETFs launch on July 23.

Ethereum Price Falls Behind Bitcoin Rally

On July 22, the Chicago Mercantile Exchange (CME), a trading platform dedicated to institutional traders in the US, announced that it had obtained a green light from regulators to list Spot Ethereum ETFs from Tuesday, July 23, 2024.

Notably, Bitcoin ETFs have pulled in over $50 billion worth of BTC holdings within 6-months of launch, sparking bullish projections that Ethereum ETFs could also receive a healthy fraction of that in inflows over the coming weeks.

Oddly, while ahead of the positive landmark event, the Ethereum price is showing early bearish signals. The chart above shows how Ethereum price has stagnated below the $3,550 resistance over the last 48-hours, meanwhile Bitcoin price has risen by another 4%, hitting a new 30-day peak of $68,747 in the process.

This suggests that while the rest of the crypto market is rallying, ETH traders are taking on a more cautious outlook in a bid to avoid a bull trap from the potential sell-the-news cycle.

This is a short-term trading strategy where investors rapidly sell an asset shortly after a positive event, to cash-in on the market euphoria. It appears the Ethereum traders are bracing up for this event ahead of the July 23, ETF launch.

ETH Market Supply Increased by $1B in July 2024

The media buzz surrounding this news has impacted the global crypto market movements considerably in the last few days. But curiously, on-chain data has showed signals that Ethereum could be witnessing some sell-pressure in the aftermath of the event.

The CryptoQuant chart below tracks the number of coins investors are currently holding in crypto exchange-hosted wallets and trading platforms. This gives insight into Ethereum’s short-term market supply trends.

Looking at the chart above we see that Ethereum investors held a total of 16.6 million ETH in exchange wallets at the close of June 30. But as the Ethereum ETF launch date drew closer, investors began to move more coins into exchanges, a move that typically occurs ahead of a major profit-taking frenzy.

Over 16,9 million ETH coins are now sitting on exchanges at the time of writing on July 23. This reflects that investors have deposited over 330,000 ETH worth since the start of July.

When valued at the current prices, this means that Ethereum market supply has increased by over $1 billion this month. Such a large increase in market supply of an asset could lead to an accelerated price decline if traders enter a sell-the-frenzy in the coming days.

Ethereum Price Forecast: Bulls Must Defend $3,400 Support

Ethereum price action on July 23 shows a minor pullback after testing resistance around the $3,600 level. This minor retracement is crucial as Ethereum bulls aim to defend the critical support at $3,400.

The Bollinger Bands indicator reveals that Ethereum has been trading within the upper half of the bands, suggesting a continuation of the upward momentum if the support holds. The middle band, currently at $3,252.96, acts as an immediate support level, with the lower band at $2,845.59, providing a more substantial floor if the price declines further.

The Relative Strength Index (RSI) sits at 55.01, slightly above the neutral 50 level. This position indicates that Ethereum is neither overbought or oversold, providing room for the bulls to push prices higher. However, the slight downward tilt of the RSI suggests caution, as any further decline could signal a shift in momentum towards the bears.

Key resistance levels to watch are $3,600, and the upper Bollinger Band at $3,660.34. Breaking through these levels could open the path towards $3,800 and beyond. On the downside, defending the $3,400 support is crucial for maintaining bullish sentiment. A drop below this level could see Ethereum retesting the $3,252.96 support and possibly the $2,845.59 level if bearish momentum intensifies.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

This article was originally published by a thecryptobasic.com . Read the Original article here. .