Quick Take

In the past 12 hours, Bitcoin’s price has experienced significant volatility, fluctuating between $54,400 and $58,200. This turbulence coincides with the German government’s ongoing sales of Bitcoin, a trend that has persisted for several weeks.

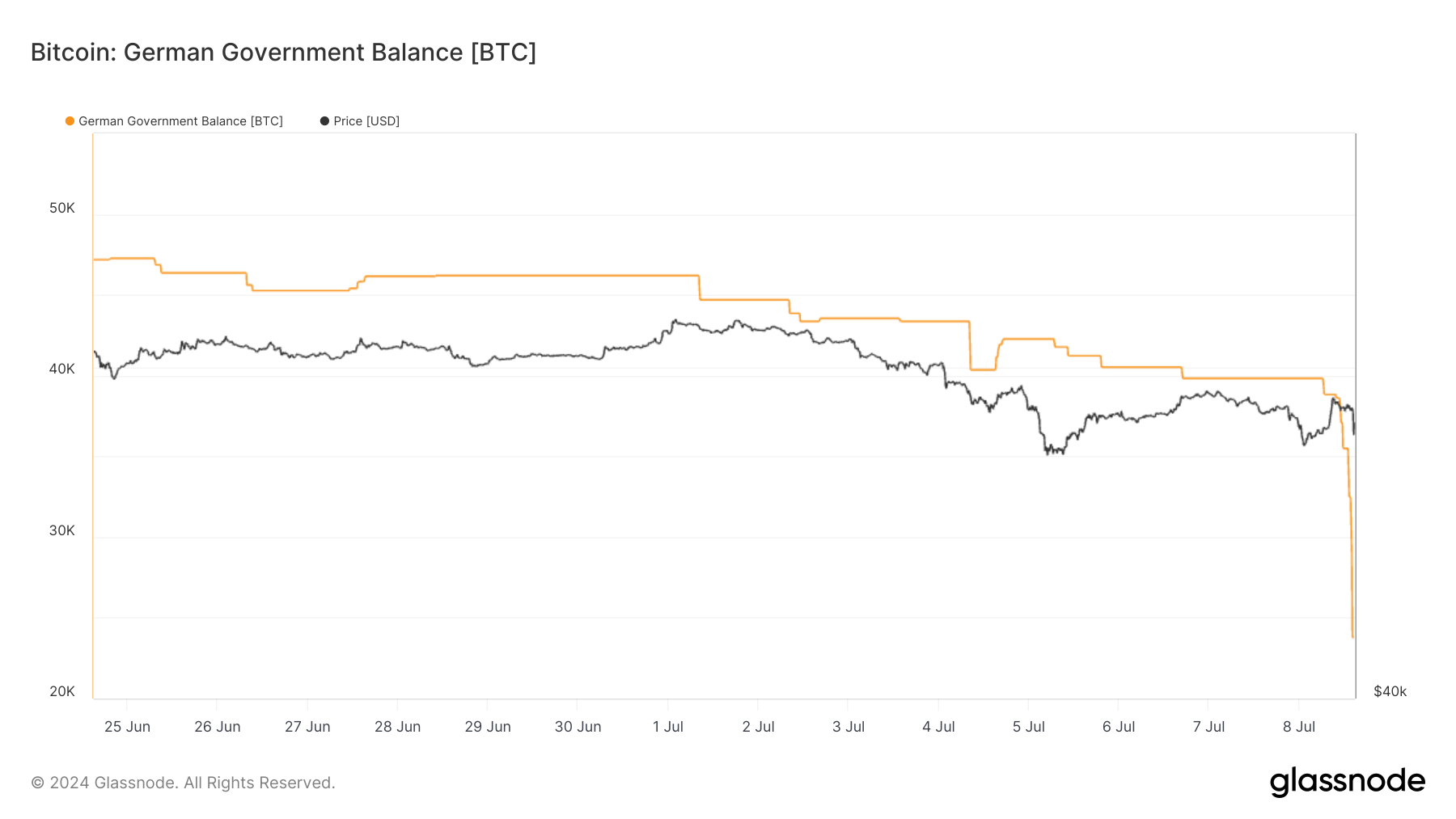

As of July 8, the German government held approximately 23,788 Bitcoin, valued at $1.32 billion — less than half of its holdings before the selling began.

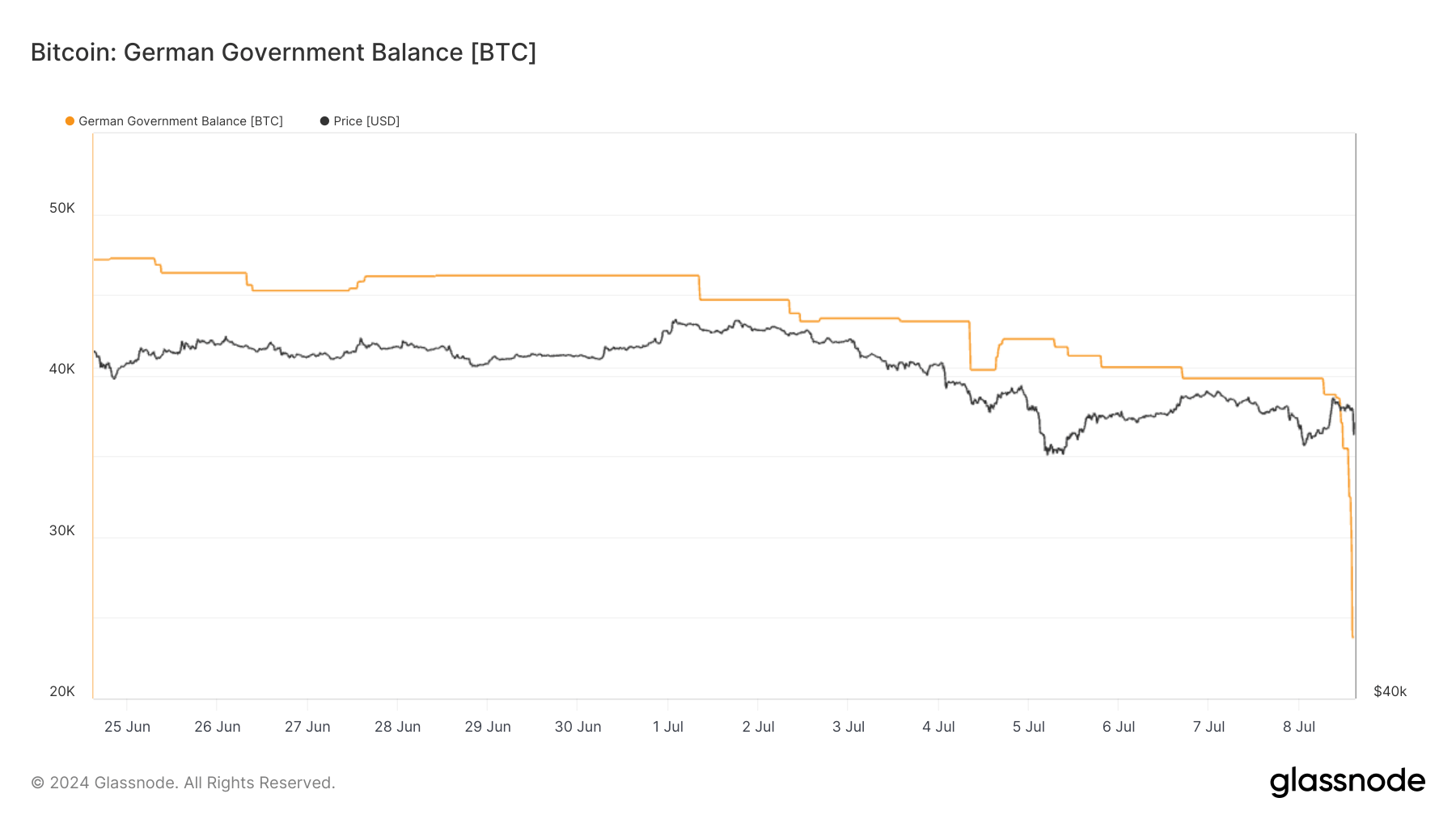

The most recent sale involved 5,200 Bitcoin, worth $293.76 million, according to Arkham Intelligence data.

The selling activity has significantly reduced futures contracts, with 50,000 Bitcoin exiting futures open interest in the past few days. Currently, around 475,000 Bitcoin remain in open interest contracts, similar to levels seen in mid-May, according to Coinglass.

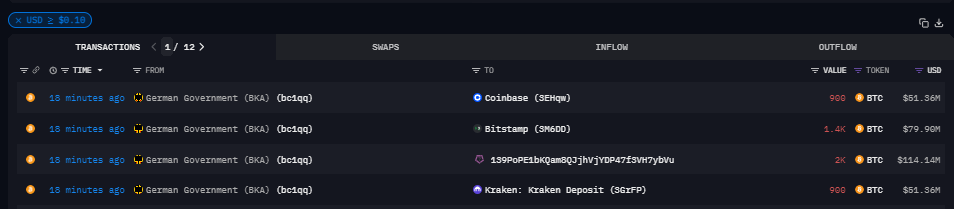

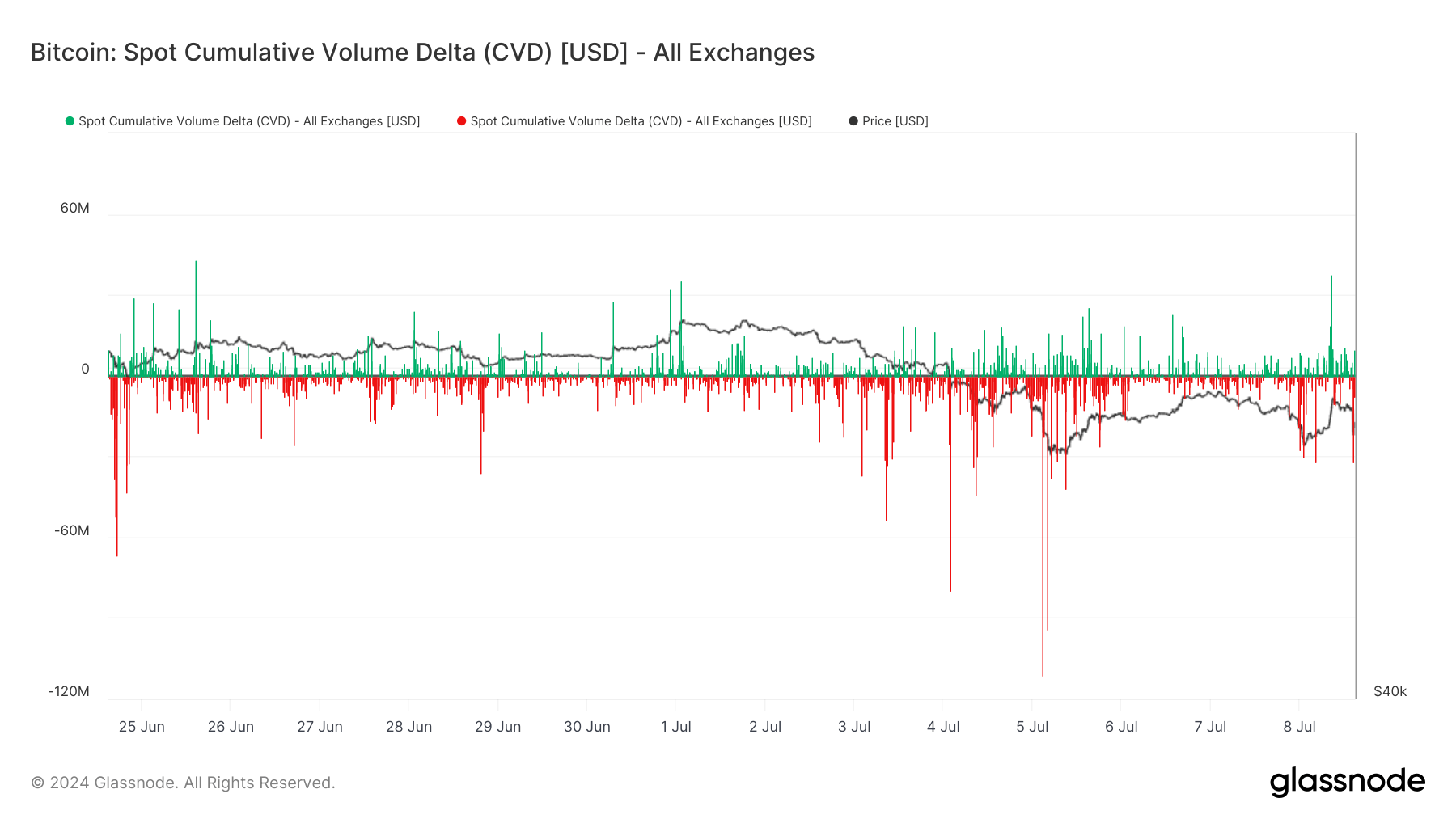

Concurrently, spot selling has also intensified, indicating robust selling pressure in the market, according to Glassnode.

This combination of government sales, spot selling and closing of futures contracts is playing a significant role in the current market dynamics, contributing to the observed volatility in Bitcoin prices.

This article was originally published by a cryptoslate.com . Read the Original article here. .